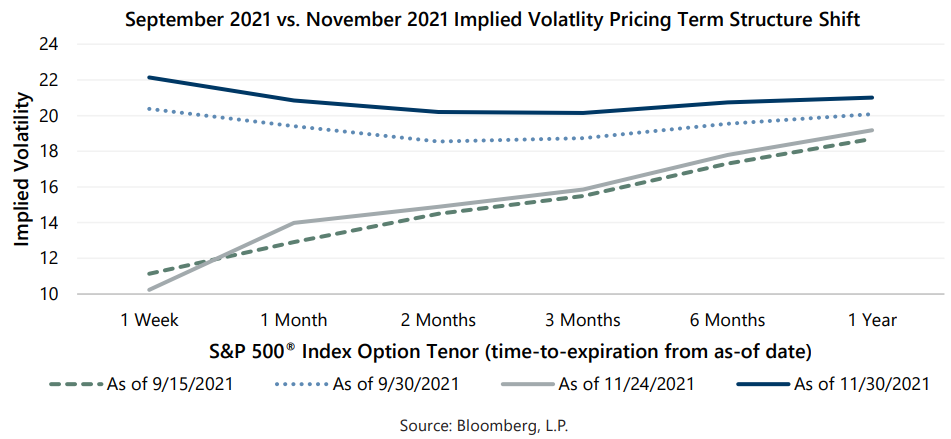

The term structure of S&P 500® Index option implied volatility (IV) changed dramatically at the end of November. The new COVID variant and surprisingly hawkish rhetoric from the Federal Reserve (the Fed) drove IV higher across tenors from one week to one year. All tenors featured IV above 20 at the end of the month, while one week IV increased by nearly 150% on November 26, resulting in an inverted IV curve.

The other notable aspect of November’s IV curve shift is how it compares to the shift witnessed in September. September’s shift was similar but not as extreme. This is notable because the equity market’s 4.97% drawdown that accompanied September’s IV curve response was larger than November’s 2.89% drawdown.

Only time will tell whether the shift in IV pricing represents investor overreaction to the new COVID variant and Fed rhetoric. However, as we noted in our October “Market Perspective: What Will Taper Do to Implied Volatility?” a spike in volatility at the onset of a Fed taper is not unprecedented. In retrospect, some of the volatility spikes that were concurrent with the Fed tapering asset purchases can be characterized as overreactions while others started phases of above-average volatility.

As always, Gateway will look for opportunities to take advantage of the current environment while vigilantly preparing to take appropriate action should conditions change.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.