Case for Low-Volatility Equity

An Index-Option Based Approach

The challenge of pursuing returns while managing risk is increasingly difficult. In an environment where the equity market is defined by the potential for significant volatility and the fixed income market is defined by interest rate uncertainty, many types of investors – from individuals to large institutions – are seeking new ways to achieve the right balance between return and risk.

Over long time periods, diversified equity portfolios have historically generated attractive returns that outpace inflation. However, when equity prices fluctuate significantly, short-term risks create challenges for long-term investors. Increased volatility tempts individual investors to abandon sound long-term strategies and poses unique challenges for institutional investors with long-term liabilities.

At Gateway, we believe strategies that reduce risk with index options can be an effective solution to a broad array of challenges faced by investors. Equity market exposure combined with index options, and their associated volatility risk premium, can mitigate equity market losses while simultaneously benefitting from the equity market’s propensity to rise over time.

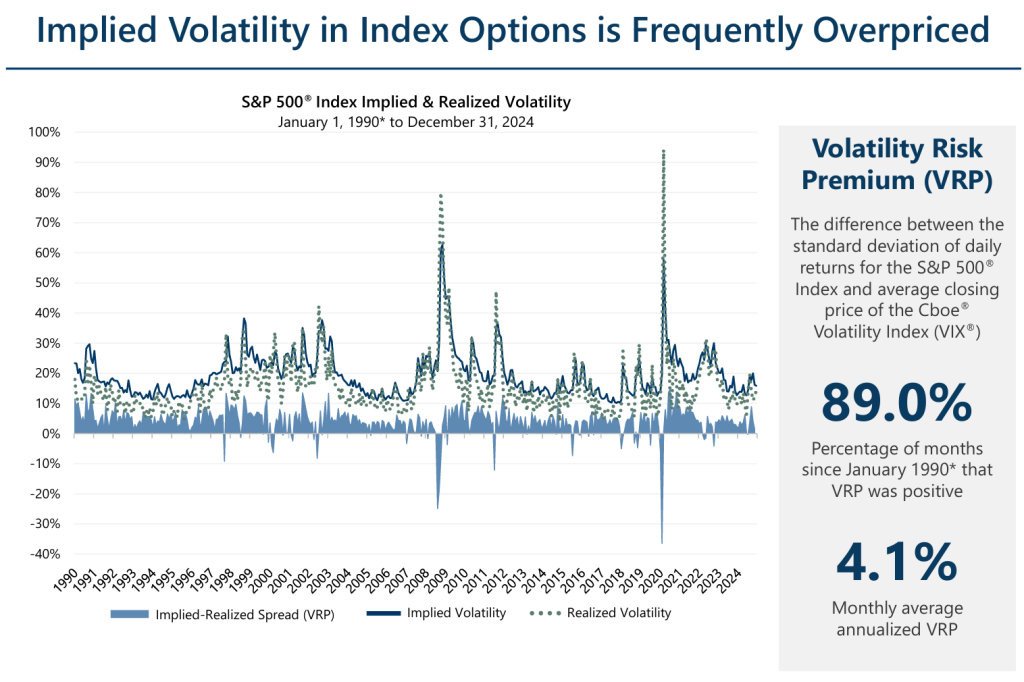

Over-Pricing of Volatility in Option Markets is a Persistent Phenomenon1

The frequent over-pricing of implied volatility relative to realized volatility represents a risk premium that creates the potential for option-writing strategies to enhance risk-adjusted return relative to broad equity market indexes. Our strategic use of index options can convert this implied equity market volatility into cash flow while maintaining equity market correlation. This consistent risk profile has the potential for less downside exposure and smaller short-term fluctuations than the underlying equity index. These characteristics may be useful to investors seeking new solutions to the ever-more challenging investment objective of adding short-term consistency to the pursuit of long-term portfolio returns.

1VIX® data available as of January 1, 1990. Past performance does not guarantee future results.