No Promises Made

No Promises Made

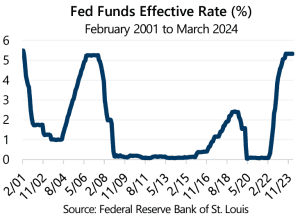

In modest fashion, the U.S. Federal Reserve (the Fed) often dominates headlines, and it has been no different during the recent period of transitioning monetary policy. Particularly when considering its relatively rapid pace of tightening that began March 2022, the Fed Funds Effective Rate has increased by nearly 26 times – growing from 0.20% to 5.33%, which is a level not seen since the February 2001 level of 5.49%.

As the Fed paused a relentless cycle of interest rate hikes after acknowledging economic resilience and a reduction in out-of-control inflation in 2023, focus for investors pivoted to the possibility of interest rate cuts. Expectations around the frequency and magnitude of such a change have been in a state of flux nearly since the thought was conceived. However, the Fed continues to choose its words wisely and does not offer any promises in its guidance. Nevertheless, in March, Fed Chairman Jerome Powell suggested the possibility remained for interest rate cuts in 2024 – assuming inflation continued a sustainable decline – with one small change. The Fed now anticipates fewer cuts than previously mentioned1.

A Moving Target

In May 2023, a regional banking crisis triggered hopes that the Fed would pause its tightening efforts and potentially reduce interest rates by the close of 2023. As explored in Cuts Can Hurt, at the end of May there was an expectation, with 57% probability, that the Fed would not only pause the rate of interest rates hikes but reverse course by November 2023 with an implied Federal Funds policy rate of 4.68% by January 2024.

With the Fed Funds Rate still north of 5% as of the end of March 2024, those expectations failed to become reality, and with no promises made, investors remain forced to digest an evolving macroeconomic environment and selective comments from the Fed.

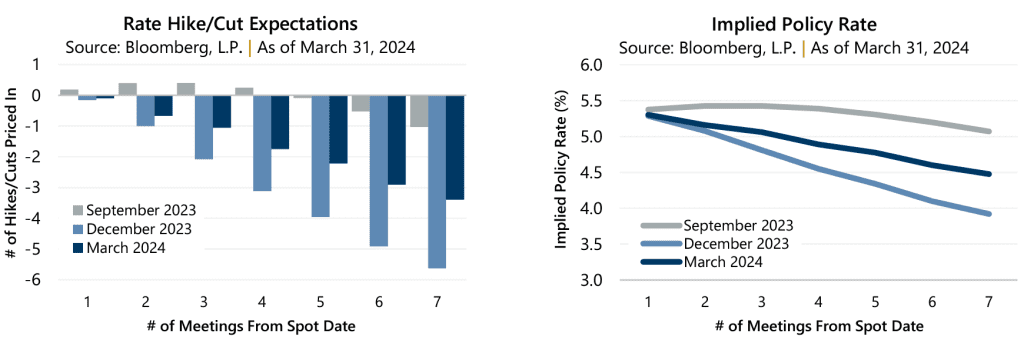

The charts below show how expectations rarely match reality. At the end of September 2023, rate hikes were again being priced in with cuts expected during the summer of 2024. Benign inflation data released during the fall of 2023, however, once again shifted expectations for a first cut in early 2024. As the Fed continued to evade an action in the first quarter of 2024 and inflation remained robust, expectations again evolved to summer 2024 before a cut might be implemented.

A Glance in the Rearview

A Glance in the Rearview

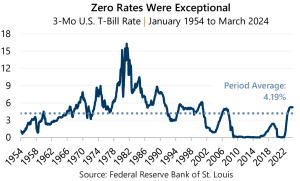

There is much uncertainty about the timing of future rate cuts and the potential market path after such a move is nuanced, and often volatile. In short, regardless of the direction of monetary policy, there is a strong possibility that interest rates settle into a more normal range and away from the near-zero levels that were driven by extraordinary monetary policy easing following the Great Financial Crisis. When considering the period of January 1954 through March 2024, the average 3-Month Treasury Bill yield for this time was 4.19%. Even if current market expectations for interest rate cuts come to fruition, the Fed Funds Rate would be near 4.5% and remain above the long-term average.

Any level away from zero continues to benefit option writing strategies, particularly when writing near-the-money call options on the S&P 500® Index, similar to those used in some Gateway strategies. For The Times, They Have Changed explains that the premium received for writing a one-month at-the-money index call option was over 9% higher with rates at 5.25% versus 0.25%. Higher interest rates have also contributed to the reduction in the cost of S&P 500® Index put options and make protection less expensive for those strategies that purchase index put options for downside loss mitigation.

Rest Easy

Gateway is not in the business of predicting Fed actions or market activity and whether the Fed begins cutting rates in 2024, continues to hold, or surprises investors with a hike, the path forward is likely to remain uncertain and volatile. However, what seems less uncertain is that interest rates are settling into a more average, to above-average range. Additionally, while macroeconomic factors continue to adjust to a new rate regime, the chances increase for unexpected and robust volatility events. Away-from-zero rates and double-digit volatility have meaningfully enhanced options-based strategies, such as those managed by Gateway since 1977, and can help investors navigate an array of market environments.

1: See: https://www.wsj.com/economy/central-banking/powell-says-fed-on-track-to-cut-rates-this-year-52e5feb3

Past Performance does not guarantee future results

Data sources: Federal Reserve Bank of St. Louis, Bloomberg, L.P., Morningstar DirectSM.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.