An Unsuspecting Year

2023’s year-end rally helped mark the S&P 500® Index’s sixth strongest annual return in the last 25 years, seemingly fueled by optimism surrounding the direction of monetary policy. Specifically, as inflation continued its descent from record heights, the U.S. Federal Reserve (the Fed) continued the pause of its recent and aggressive interest rate hiking cycle. The extended pause and changing tone of the Fed led to increasing expectations of rate cuts in 2024, prompting cheers from investors as 2023 ended.

The most interesting thing about expectations, however, is that they rarely align with reality. For instance, at the onset of 2023, with a rapid and significant departure from the quantitative easing approach of the prior decade or more, the consensus was that the Fed had been too aggressive and risked pushing the U.S. economy into recession. Reality checked-in, though, with a surprisingly strong economy and resilient labor market that helped drive a more than 26% advance in the S&P 500® Index. So, what is next?

Forget Your Crystall Ball

Predicting performance for 2024 is a fool’s game of course, but a review of historical data may help investors prepare for a variety of outcomes. Over the past 25 years the S&P 500® Index has advanced at an annual rate of 20% or more eight times. The average return for the S&P 500® Index over that timeframe was 9.2%, but in the years following a 20% or more advance, the equity market return averaged just 3.8%. Positive, but hardly as exciting as 2023’s results or the period average. Group this with ample drivers of volatility on the horizon such as a U.S. presidential election, growing geopolitical tensions, and ongoing wars, and risk management may be prudent in 2024.

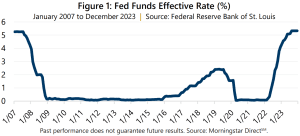

Adding to the uncertainty, and likely to remain in focus, are the decisions to be made by the Fed. As Figure 1 shows, after starting 2022 at 0.08%, the Fed Funds Rate was increased to 5.33% by August 2023, before being held steady through year-end. As a result, monetary policy has departed the comfort of quantitative easing and, instead, interest rates may settle into a range more closely aligned with the long-term averages. For instance, the rate on a 3-month U.S. Treasury Bill has averaged 4.19% since 1954 and closed 2023 at 5.24%.

Adding to the uncertainty, and likely to remain in focus, are the decisions to be made by the Fed. As Figure 1 shows, after starting 2022 at 0.08%, the Fed Funds Rate was increased to 5.33% by August 2023, before being held steady through year-end. As a result, monetary policy has departed the comfort of quantitative easing and, instead, interest rates may settle into a range more closely aligned with the long-term averages. For instance, the rate on a 3-month U.S. Treasury Bill has averaged 4.19% since 1954 and closed 2023 at 5.24%.

Drastic changes to monetary policy and other macro drivers of uncertainty have also shifted implied volatility, as measured by the Cboe® Volatility Index (the VIX®), to more normal ranges than experienced during quantitative easing. After the Great Financial Crisis (GFC), as the Fed carefully managed the recovery, the VIX® fell from crisis highs to an all-time low of 9.14 on November 3, 2017. Since the Fed started tightening monetary policy in 2022 through the close of 2023, the VIX® has ranged from 12.07 to 36.45.

Prepping

When using options, investors may recall that interest rates and volatility – two components of the Black-Scholes option pricing model – play a significant role in option pricing. These two components to pricing were less-than-robust in their contributions to option-based strategies during the quantitative easing period. However, these factors may persist in their recent shift higher and this environment might continue to benefit option-based strategies.

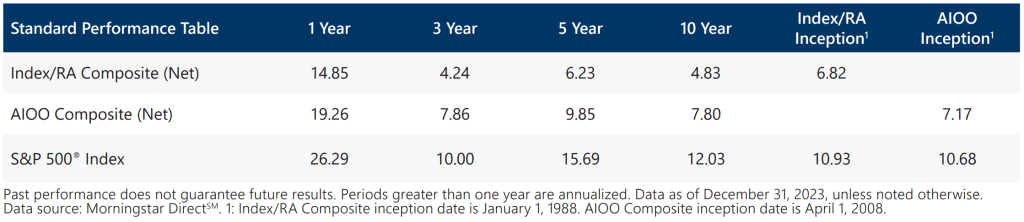

In this new environment, for instance, Gateway’s option-based strategies had some of their strongest returns ever. 2023 marked the best year in 25 years for Gateway’s flagship Index/RA Composite (Index/RA). Index/RA captured 36% of the equity market advance in 2019 with a return of 11.29%, net of fees, contrasting with 2023’s market environment in which Index/RA returned 14.85%, net of fees, and captured 56% of the S&P 500® Index’s 26.29% return. Gateway’s Active Index-Option Overwrite Composite (AIOO) had a similar outcome, posting its best annual return since its 2008 inception. AIOO climbed 17.42% and 19.26%, net of fees, in 2019 and 2023, respectively, and captured 55% of the market advance in 2019 while capturing 73% during 2023. (A GIPS® Composite Report for Index/RA and AIOO is included with this Commentary.)

Gateway’s investment philosophy holds that the equity market is the most reliable source of long-term real returns and consistency is the key to long-term investment success. Generating cash flow through monetizing volatility, rather than seeking to forecast the rise and fall of the market, can be a lower risk means to participate in equity markets. Strategies that employ index option writing offer exposure to richly priced implied volatility and can also benefit from higher levels of interest rates, helping to offset some risks associated with rising interest rates. This combination, prevalent in today’s challenging environment, provides investors the potential to generate attractive risk-adjusted returns over the long-term.

While predicting the future can be a fool’s errand, history suggests that both interest rates and implied volatility may remain near levels closer to their historical average than those experienced during the quantitative easing period post-GFC. Strategies such as those managed by Gateway, which can actively take advantage of a dynamic market environment, may be positioned well for 2024. Such strategies are designed to help investors despite their expectations for the year. Specifically, Gateway can help investors maintain market exposure in the case reality surprises to the upside, or manage risk should 2024 produce a less-than-pleasant reality check.

Past Performance does not guarantee future results

Data sources: Bloomberg, L.P. and Morningstar DirectSM, and St. Louis Federal Reserve Bank of St. Louis.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.