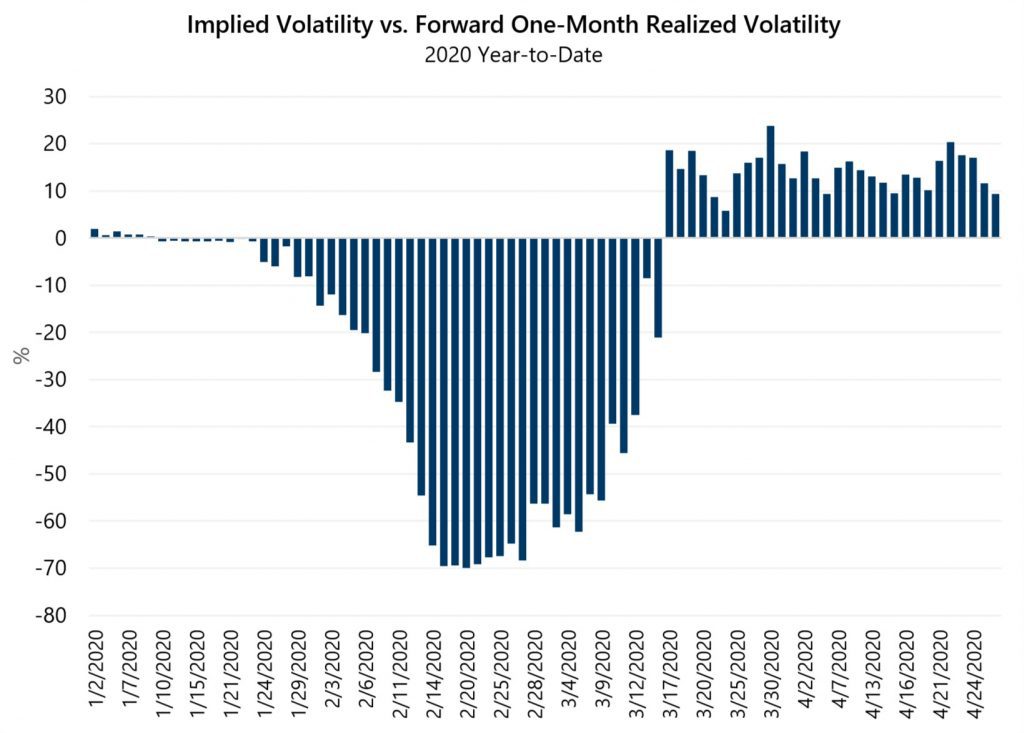

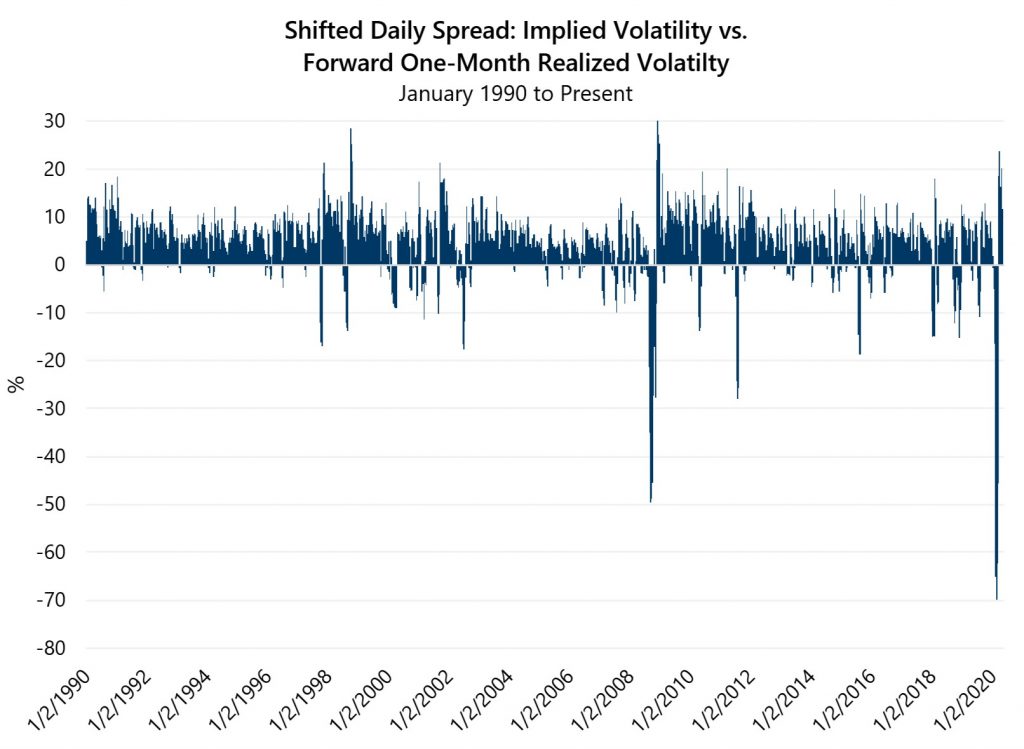

Our April Market Perspective focused on how the Volatility Risk Premium (VRP) has changed over time and noted that its first quarter of 2020 inversion reached record-setting levels in February. VRP has been positive since mid-March, and averaged 14.23 from March 17 through April 28, i.e. the 21-day1 realized volatility period ending May 27.

The VRP average since March 17 is nearly three times the average positive VRP reading since September 2008 and, as the longer-term chart shows, recent VRP readings are the highest since December 2008. Writing index options in this environment has strong potential for enhancing risk-adjusted returns while achieving a lower-risk profile than the broader equity market.

* Source: Bloomberg, L.P.

1Equity and index option markets are open approximately 21 days per month, on average.