Daily closing values for the Cboe® Volatility Index (the VIX®) have been below its long-term average of 19.61 less than 10% of the time so far in 2022. That, in combination with a relatively high frequency of closing values over 30, has pushed the year-to-date average for the VIX® to 25.66. This puts the VIX® on pace to post a calendar year average above 20 for just the second time in the last 10 years, with 2020 being the other instance.

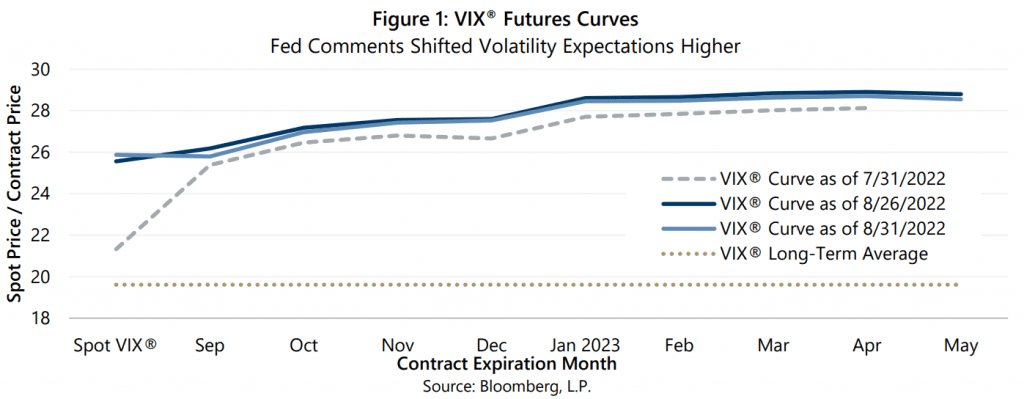

The VIX® futures curve has reflected market expectations of implied volatility remaining in the mid- to upper-20s for much of 2022. Moreover, volatility expectations shifted even higher on August 26 when the Federal Reserve (the Fed) Chairman Powell made it clear that the Fed would not be making a dovish pivot any time soon. The VIX® futures curve remained elevated through the end of August and reflected expectations of upper-20s VIX® levels well-into 2023.

The VIX® futures curve has reflected market expectations of implied volatility remaining in the mid- to upper-20s for much of 2022. Moreover, volatility expectations shifted even higher on August 26 when the Federal Reserve (the Fed) Chairman Powell made it clear that the Fed would not be making a dovish pivot any time soon. The VIX® futures curve remained elevated through the end of August and reflected expectations of upper-20s VIX® levels well-into 2023.

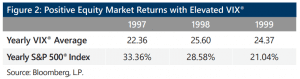

It is important to note that, even though implied volatility tends to rise when the equity market falls, persistently elevated implied volatility does not necessarily equate to persistently falling equity markets. As the table in Figure 2 shows, the late 1990s saw three consecutive years of elevated VIX® averages combined with very attractive equity market returns.

It is important to note that, even though implied volatility tends to rise when the equity market falls, persistently elevated implied volatility does not necessarily equate to persistently falling equity markets. As the table in Figure 2 shows, the late 1990s saw three consecutive years of elevated VIX® averages combined with very attractive equity market returns.

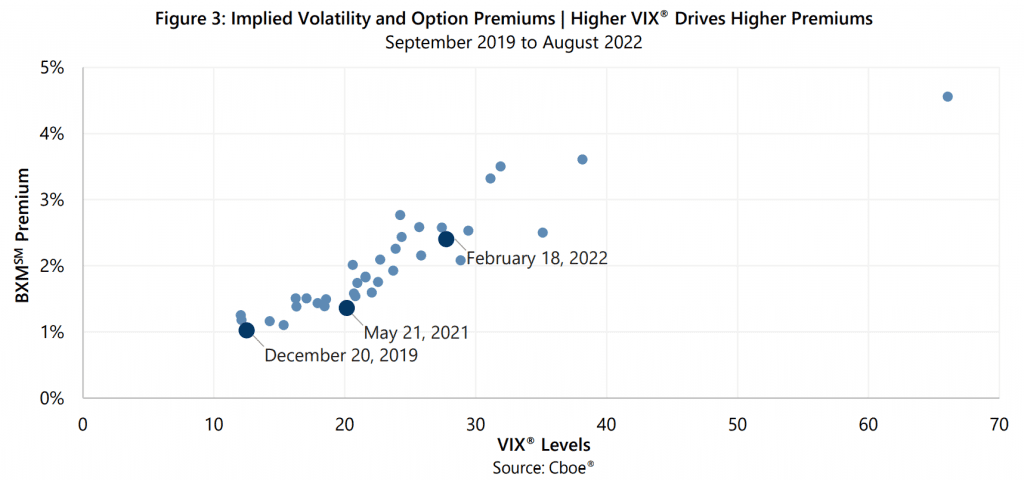

If VIX® levels are not reliable indicators of market direction, how can implied volatility help investors manage risk? Higher implied volatility creates higher index option prices. Writing index options generates cash flow that has a positive relationship with implied volatility – higher VIX® levels result in greater amounts of cash flow from index option writing. Strategies that combine equity market exposure with option writing cash flow can benefit from elevated VIX® levels through potentially improved outcomes in both up-market and down-market scenarios. Figure 3 illustrates the relationship between the VIX® level and the monthly call-writing premiums generated by the Cboe® S&P 500 BuyWrite Index (the BXMSM) over the last 36 months, which covers a representative sample of VIX’s® historical range. When the VIX® is close to its historical average level, as it was on May 21, 2021 when it closed at 20.15, a strategy that writes one-month at-the-money options may receive a premium similar to the 1.36% (note: monthly premium amounts are not annualized) that the BXMSM received on that day. On days with higher VIX® levels, premiums will be higher. For example, the VIX® closed at 27.75 on February 18, 2022 and the BXMSM received a premium of 2.40%. Conversely, lower VIX® results in lower premiums and less cash flow for option writing strategies, such as when the VIX® closed at 12.51 on December 20, 2019 and the BXMSM received a premium of 1.02%.

What Gateway’s actively managed low volatility equity strategies have in common with the BXMSM is that both combine equity market exposure with option writing cash flow to generate returns that are correlated with the equity market but have lower risk than the S&P 500® Index in terms of standard deviation, beta and participation in down markets. Cash flow generated from option premiums is a key element of delivering this low volatility equity profile. The amount of cash flow received is a large factor in the level of loss mitigation when the market falls. Higher implied volatility produces more cash flow, which represents a higher level of loss mitigation as cash flow cushions losses from equity market exposure. Cash flow also represents return potential over periods of time when the market does not fall. When the market rises, received cash flow allows the strategy to participate in the market advance—higher cash flow results in more participation. Just as importantly, potential return from cash flow does not require a rising market for return potential to be realized. If the market return is flat over a period of time, strategies that combine equity market exposure with option writing cash flow can produce positive returns even when the market return is essentially zero.

Heightened levels of volatility in markets can be cause for concern to many investors. Not being prepared or positioned properly can cause stress on a portfolio and cause investors to make irrational decisions. Low-volatility equity strategies that rely on cash flow from index option selling to both mitigate equity market losses as well as participate in equity market advances, like those managed by Gateway since 1977, can be particularly attractive during these times of high volatility.

Heightened levels of volatility in markets can be cause for concern to many investors. Not being prepared or positioned properly can cause stress on a portfolio and cause investors to make irrational decisions. Low-volatility equity strategies that rely on cash flow from index option selling to both mitigate equity market losses as well as participate in equity market advances, like those managed by Gateway since 1977, can be particularly attractive during these times of high volatility.

Past performance is no guarantee of future results.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.