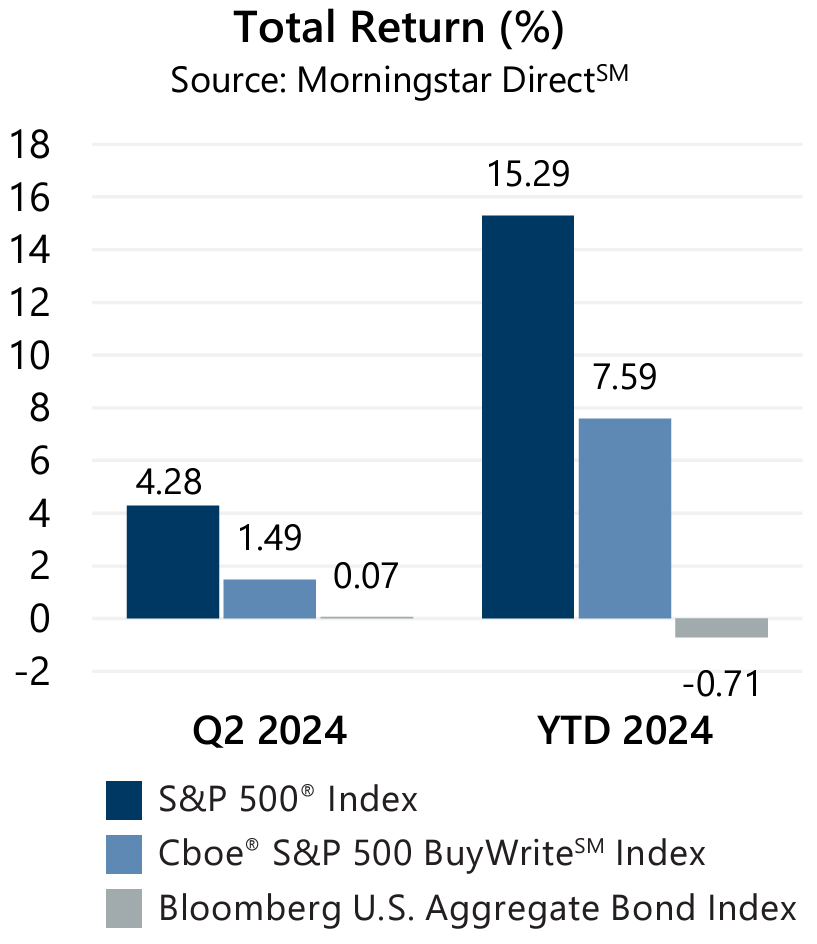

With returns of -4.08%, 4.96%, and 3.59% in April, May, and June, respectively, the second quarter of 2024 started with a slump as the euphoria of an expected half dozen rate cuts fizzled out like soggy fireworks. April was the equity market’s first monthly decline since October 2023 and included the new year-to-date 2024 maximum drawdown of -5.40% from the end of March through April 19. U.S. Federal Reserve (the Fed) activity weighed on investors’ minds throughout the remainder of the quarter, but a slow acceptance of normalized interest rates, along with an artificial intelligence technology boom, fueled the 10.24% advance from April 19 through quarter-end and a new all-time high for the S&P 500® Index.

With returns of -4.08%, 4.96%, and 3.59% in April, May, and June, respectively, the second quarter of 2024 started with a slump as the euphoria of an expected half dozen rate cuts fizzled out like soggy fireworks. April was the equity market’s first monthly decline since October 2023 and included the new year-to-date 2024 maximum drawdown of -5.40% from the end of March through April 19. U.S. Federal Reserve (the Fed) activity weighed on investors’ minds throughout the remainder of the quarter, but a slow acceptance of normalized interest rates, along with an artificial intelligence technology boom, fueled the 10.24% advance from April 19 through quarter-end and a new all-time high for the S&P 500® Index.

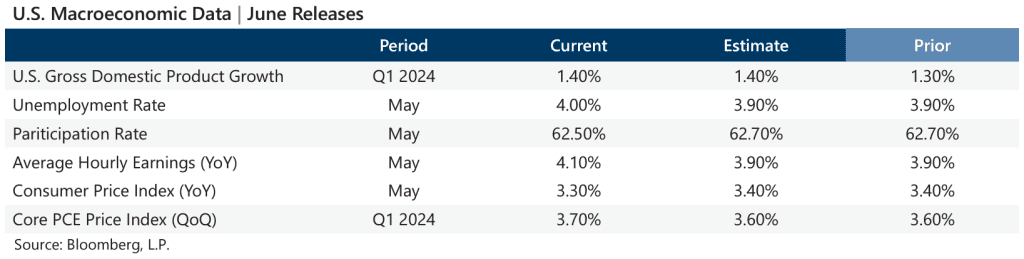

Data released in June showed a stable macroeconomic backdrop and stubborn inflation, supporting the Fed’s case to hold steady with current rates. The third estimate of Gross Domestic Product for the first quarter of 2024 matched the consensus estimate, though a slight improvement from the prior estimate. The year-over-year May Consumer Price Index, released June 12, was slightly lower than the previous reading and consensus estimates although the quarter-over-quarter Personal Consumption Expenditures (PCE) Price Index, the Fed favorite, showed an increase from the prior reading and was above consensus expectations. Corporate earnings stayed positive with first quarter aggregate operating earnings climbing 1.0% quarter-over-quarter and 7.7% year-over-year. With now over 99% of S&P 500® Index companies reporting, 82% met or exceeded analyst estimates.

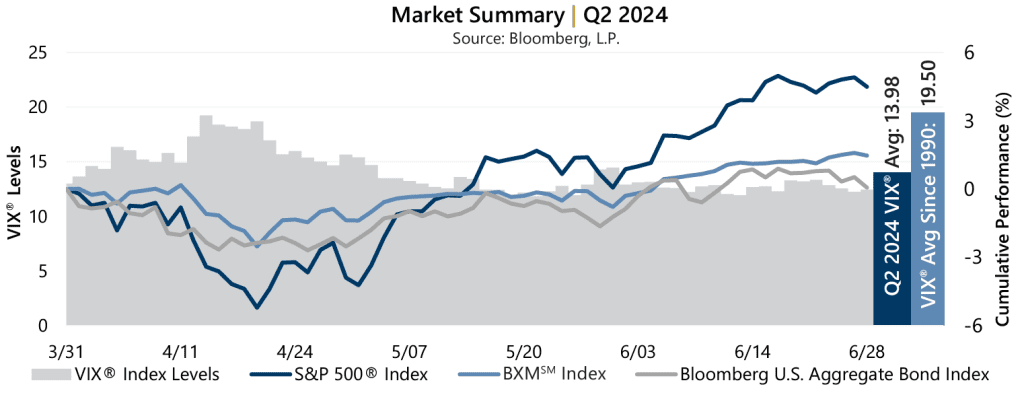

Implied volatility, as measured by the Cboe® Volatility Index (the VIX®), averaged 13.98 in the second quarter. Consistent with its typical relationship, average implied volatility exceeded realized volatility, as measured by the standard deviation of daily returns for the S&P 500® Index, which was 10.51% for the quarter. The VIX® ended March at 13.01 and reached an intra-quarter high of 19.23 on April 15 – a level not seen since October 2023 – as the equity market shifted lower on declining prospects for softening monetary policy. As the market advanced through quarter-end, the VIX® closed at an intra-quarter low of 11.86 on May 21 before ending the quarter at 12.44. The spread between implied and realized volatility, or the Volatility Risk Premium (VRP), was robust and increasing throughout the quarter. The VRP in June was 628 basis points (bps), well above the long-term average of 407 bps and the highest monthly spread since October 2021.

The Cboe® S&P 500 BuyWriteSM Index1 (the BXMSM) returned 1.49% during the second quarter, with returns of -1.36%, 1.09%, and 1.77% in April, May, and June, respectively. From the start of 2024 through quarter-end, the BXMSM has returned 7.59%. The premiums the BXMSM collected as a percentage of its underlying value provided downside loss mitigation. The BXMSM collected premiums of 1.72%, 1.39%, and 1.36% in April, May, and June, respectively.

The Cboe® S&P 500 BuyWriteSM Index1 (the BXMSM) returned 1.49% during the second quarter, with returns of -1.36%, 1.09%, and 1.77% in April, May, and June, respectively. From the start of 2024 through quarter-end, the BXMSM has returned 7.59%. The premiums the BXMSM collected as a percentage of its underlying value provided downside loss mitigation. The BXMSM collected premiums of 1.72%, 1.39%, and 1.36% in April, May, and June, respectively.

After the equity market advance in March, the BXMSM entered April with relatively low market exposure which increased until the market’s intra-quarter low on April 19, at which time the BXMSM wrote its new index call option with a May expiration and reset its market exposure. From the close of March to April 19, the BXMSM offset 289 bps of downside protection with a return of -2.51% relative to the -5.40% decline of the S&P 500® Index. From April 19 to quarter-end, the BXMSM returned 4.09%, though the passive, rules-based approach paired with premiums collected in May and June were insufficient in keeping pace with the rapid advance of the S&P 500® Index.

The Bloomberg U.S. Aggregate Bond Index (the Agg) returned 0.07% in the second quarter with monthly returns of -2.53%, 1.70%, and 0.95%, respectively. Year-to-date through June 2024, the Agg has returned -0.71%. The yield on the 10-year U.S. Treasury Note (the 10-year) ended March at 4.20% and reached an intra-quarter high of 4.70% on April 25. The 10-year drifted to an intra-quarter low of 4.22% in June and closed the quarter at 4.40%. The historical yield curve inversion continued through the second quarter, with the yield on the 2-year U.S. Treasury Note exceeding that of the 10-year since July 5, 2022.

1The BXMSM is a passive total return index designed to track the performance of a hypothetical buy-write strategy on the S&P 500® Index. The construction methodology of the index includes buying an equity portfolio replicating the holdings of the S&P 500® Index and selling a single one-month S&P 500® Index call option with a strike price approximately at-the-money each month on the third Friday of the standard index-option expiration cycle and holding that position until the next expiration.

Sources: Morningstar DirectSM, Bloomberg, L.P. Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com.