Shorting vs Selling Volatility – What’s The Difference?

Shorting vs Selling Volatility – What’s The Difference?

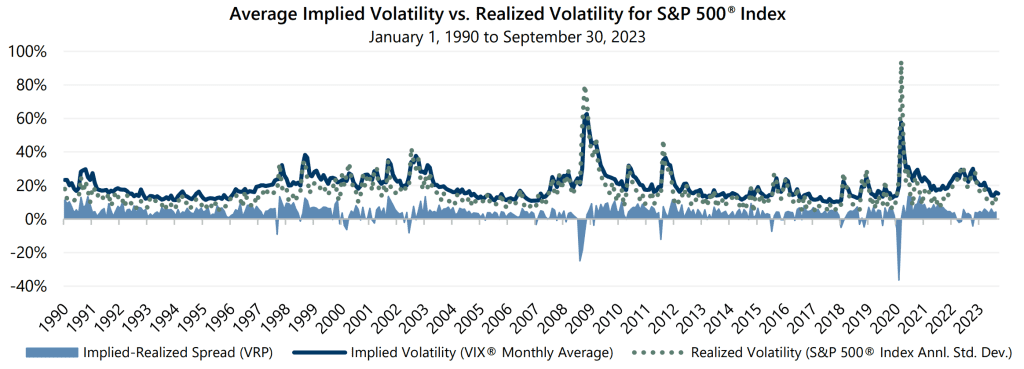

So far in 2023 there has been an abundance of headlines driving persistent uncertainty. Risks abound in light of rapid interest rate increases, high inflation, shifts in fiscal and monetary policy, geopolitical tensions and ongoing conflict abroad. Despite the appearance of chaos, implied volatility, as measured by the Cboe® Volatility Index (the VIX®), has averaged 17.37 year-to-date – far beyond levels experienced during quantitative easing but below the since 1990 inception average of 19.62.

During the summer, as volatility receded and the economy remained resilient amidst the Federal Reserve’s (the Fed) inflation-taming efforts, a number of investors set expectations that volatility would quickly recede after any bout and began betting against short-term futures tied to the VIX®. Shorting volatility is making a directional bet that volatility will remain relatively compressed while exposing investors to unlimited losses and assumes unforeseen events will have a muted impact on volatility. This was a popular strategy in the low-volatility quantitative easing era, during which the Fed managed markets with the utmost caution and implied volatility was routinely very depressed, compared to historical levels.

How to Benefit from Volatility

Some investors may remember how short-volatility strategies turned out after implied volatility suddenly spiked (and did not quickly recede) in early 2018. Spoiler alert: it did not end well. Rather than betting on the direction of volatility and an uncertain future, investors may prefer to contemplate a less-risky approach. Options-based strategies that sell volatility may allow investors to capture the difference between realized and implied volatility, or the Volatility Risk Premium (VRP), while generating cash flow. In addition, this type of strategy can be an uncorrelated approach to most other investment strategies and provides diversification to an investment portfolio.

Higher levels of implied volatility can enhance the potential returns of such a strategy and data suggests that the spread exists in a variety of market conditions, including during periods of lower volatility (and higher rates). Although implied volatility can expand during an equity market advance, it is generally when markets decline that it expands the most. Shorting volatility has the potential to compound losses when markets are down. In contrast, active options-based strategies can take advantage of tumultuous markets. In the case of an equity market decline, premiums collected from writing options can increase. Those premiums can then be used to purchase the underlying basket at lower market prices, enabling the potential to further benefit once the market recovers and asset prices rise.

Time for Experience

Understanding these concepts is crucial to the success of investors considering shorting versus selling volatility. As discussed in Times Have Changed, the investing backdrop has been significantly altered over the past year. Interest rates have surged at a breakneck pace, volatility has shifted higher and out of its muted quantitative-easing era range and investors may be weary of expecting a return to an environment of low rates and low volatility. Tested, active options-based approaches have the potential to benefit from these trends while helping reduce risk and enhance portfolio outcomes.

Since 1977, Gateway’s investment approach has focused on stability, risk-adjusted performance and long-term growth. Our index option-based strategies have steady track records, consistent risk profiles and are poised to continue benefitting from the current market environment that includes interest rates away from zero, a robust volatility risk premium, and implied volatility persistently in the double-digits.

Past Performance does not guarantee future results

Data sources: Bloomberg, L.P. and Morningstar DirectSM.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.