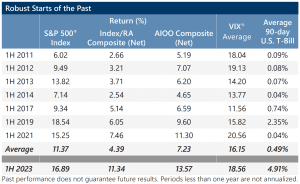

Despite overwhelming expectations of doom and gloom at the beginning of 2023, the equity market had an excellent first half of the year (and continued its strength into July). Since the end of the Great Financial Crisis (GFC) in 2009, the S&P 500® Index has only had a better first half one time – in 2019. It seems so long ago, but during the first half of 2019, the S&P 500® Index returned 18.54% compared to the 16.89% return in the first half of 2023. These two starts far exceeded the average. Since the GFC, the average S&P 500® Index return in the first six months of a year was 5.18% and was positive 80% of the time.

Meanwhile, 2019 and 2023 paint two very different pictures for Gateway’s low-volatility, options-based strategies. Investors may recall from their undergrad education that interest rates and volatility – two components of the Black-Scholes option pricing model – play a significant role in option pricing, and thus option-based strategies. These two components were less robust in their contributions during the quantitative-easing period in which the U.S. Federal Reserve closely monitored equity and credit markets for outbursts of volatility while keeping interest rates near zero.

So, what has changed in such a short timeframe? Well, the entire world – and specifically, levels of volatility and interest rates that feed into at least two Black-Scholes components. In 2019, the Cboe® Volatility Index (the VIX®) averaged 15.39 and the average yield on a 90-day U.S. Treasury Bill (T-bill) was 2.08%. In contrast, in the first half of 2023, the VIX® averaged 18.56 and the 90-day T-bill had an average yield of 4.91%.

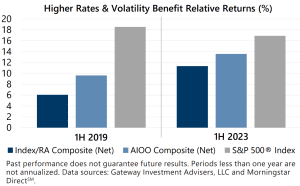

The benefits of higher volatility and away-from-zero interest rates can be seen in the recent returns of Gateway’s options-based strategies. A shift higher has the potential to persist with an abundance of looming potential drivers of volatility and a low likelihood of returning to the low interest rates experienced during quantitative-easing post GFC, as discussed previously in Times Have Changed.

The benefits of higher volatility and away-from-zero interest rates can be seen in the recent returns of Gateway’s options-based strategies. A shift higher has the potential to persist with an abundance of looming potential drivers of volatility and a low likelihood of returning to the low interest rates experienced during quantitative-easing post GFC, as discussed previously in Times Have Changed.

Gateway’s flagship Index/RA Composite (Index/RA) captured nearly 33% of the equity market advance in the first six months of 2019 with a return of 6.05%, net of fees. This contrasts with 2023 in which Index/RA returned 11.34%, net of fees, capturing over 67% of the S&P 500® Index 16.89% return. Gateway’s Active Index-Option Overwrite Composite (AIOO) had a similar outcome, climbing 9.60% and 13.57%, net of fees, in the first half of 2019 and 2023, respectively. AIOO captured nearly 52% of the market advance in 2019 while capturing over 80% during 2023. (A GIPS® Composite Report is included with this Commentary.)

Since the GFC, there have been seven other years where the S&P® 500 Index was on pace for double-digit returns as of mid-year. During those respective years which include 2011-2014, 2017, 2019 and 2021, Index/RA had an average return of 4.39%, net of fees, versus 11.37% for the S&P 500® Index – an upside capture of nearly 39%. During these years, the VIX® averaged 16.15 and the 90-day T-bill yield averaged 0.49%. In 2023, the combination of relatively higher volatility and interest rates (that were suddenly 4% higher) contributed to a significant increase in Index/RA’s upside participation.

Since the GFC, there have been seven other years where the S&P® 500 Index was on pace for double-digit returns as of mid-year. During those respective years which include 2011-2014, 2017, 2019 and 2021, Index/RA had an average return of 4.39%, net of fees, versus 11.37% for the S&P 500® Index – an upside capture of nearly 39%. During these years, the VIX® averaged 16.15 and the 90-day T-bill yield averaged 0.49%. In 2023, the combination of relatively higher volatility and interest rates (that were suddenly 4% higher) contributed to a significant increase in Index/RA’s upside participation.

AIOO also benefitted from the positive effects of higher volatility and significantly higher interest rates. For the seven years referenced above, AIOO returned 7.23%, net of fees, versus 11.37% for the S&P 500® Index – for an upside capture of almost 64%. Absolutely respectable, but as the volatility and rate environment has changed in 2023, AIOO climbed 13.57%, net of fees, capturing over 80% of the S&P 500® Index 2023 return through June.

Gateway’s investment philosophy holds that the equity market is the most reliable source of long-term real returns and consistency is the key to long-term investment success. Generating cash flow through monetizing volatility, rather than seeking to forecast the rise and fall of the market, can be a lower risk means to participate in equity markets. Strategies that employ index option writing offer exposure to richly priced implied volatility and can also benefit from higher levels of interest rates, helping to offset some risks associated with rising interest rates. This combination, prevalent in today’s challenging environment, provides investors the potential to generate attractive risk-adjusted returns over the long-term.

Past performance does not guarantee future results. Periods greater than one year are annualized. Data as of June 30, 2023 unless noted otherwise. Data sources: Gateway Investment Advisers, LLC and Morningstar DirectSM. 1: Index/RA Composite inception date is January 1, 1988. AIOO Composite inception date is April 1, 2008 .

Past performance is no guarantee of future results.

Data sources: Bloomberg, L.P. Federal Reserve Bank of St. Louis, and Morningstar DirectSM.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.