The Company You Keep

Investing in quality stocks can offer a powerful combination of defensive resilience and long-term growth potential. These companies have often been better equipped to navigate economic uncertainty and market volatility than their lower-quality peers due to their strong balance sheets, high profitability, healthy return-on-equity or assets (ROE or ROA), and abundant cash flow generation. Focusing on the durability and financial prudence that these companies offer can result in a smoother investment journey by mitigating sharp drawdowns that can derail a long-term strategy.

A disciplined equity optimization approach – supported by a seasoned team – can distill numerous fundamental variables crucial for comparing a company’s health against its peers. By seeking characteristics of high profitability and avoiding those associated with excessive leverage, investors can enjoy financially durable businesses that stand out as the quality leaders within their respective industries.

An effective quality-focused strategy requires searching for these attributes throughout the broad market. Omitting entire industries or overly large and/or impactful index holdings may lead to unintended portfolio risks and missed opportunities. A more robust approach aims for broad exposure while seeking out quality companies within each industry, where possible. This ensures the portfolio remains well-diversified and is composed of quality leaders from every corner of the market, creating the potential for a more resilient and comprehensive portfolio.

The Score You Earn

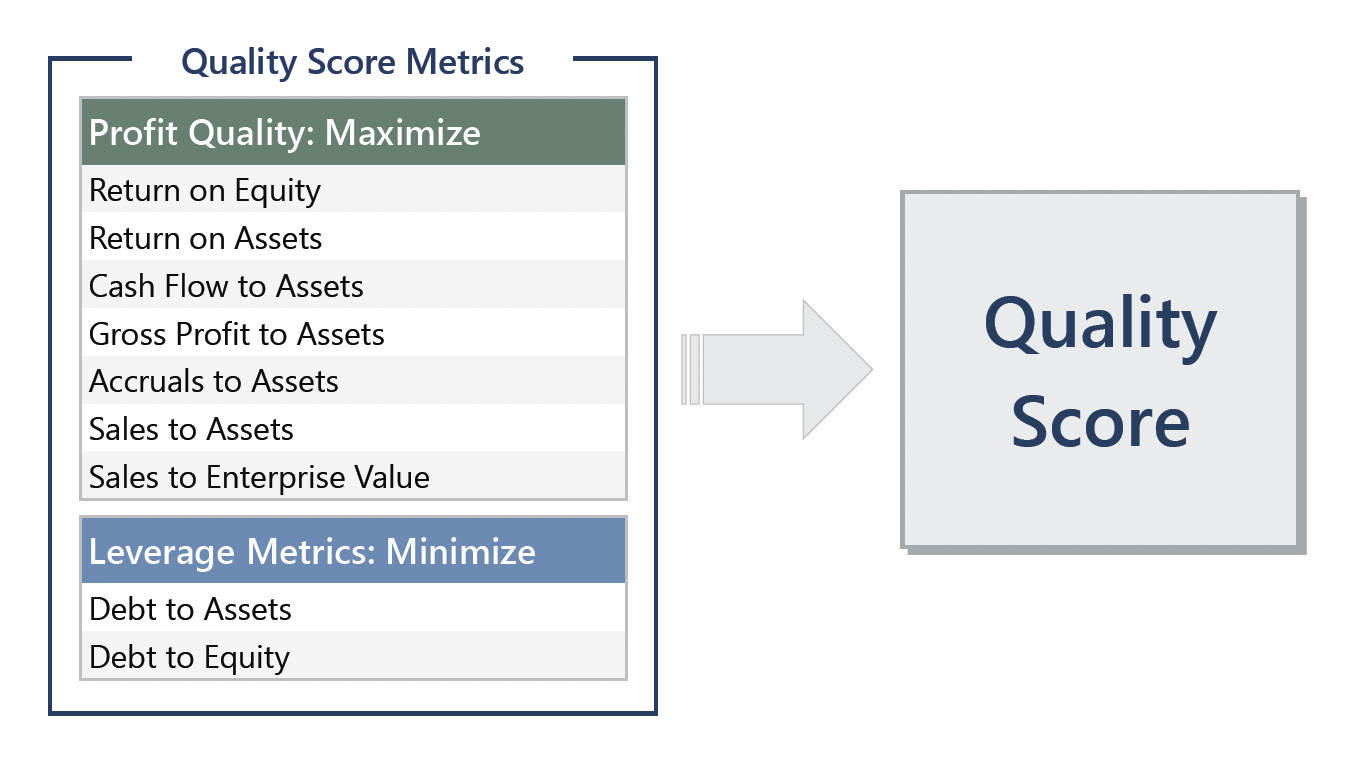

By emphasizing quality within an equity portfolio, investors have the potential to harness the benefits of healthy firms – balancing long-term growth with defense. Gateway has identified a set of key metrics that it feels indicate strong, quality companies and has developed a distinct investment process aimed to increase a portfolio’s overall quality score.

With the broad S&P 500® Index as the investment universe, this process results in a highly-diversified portfolio of companies with established track records of profitability and strong fundamentals. With discretion and experience in quantitatively managing equity portfolios, the portfolio management team optimizes the quality score of the equity portfolio by identifying opportunities to maximize profitablity metrics and minimize leverage metrics.

This quantitative approach helps ensure broad market exposure and creates an efficent investment process – avoiding the time consuming and resource-heavy fundamental research on individual companies and/or industries.

Access to Quality

Gateway’s Quality Income strategy combines the firm’s experience in quantitatively driven equity portfolio management and index option-based investing to provide a strategy that seeks to deliver consistent long-term growth and monthly income driven by equity market volatility.

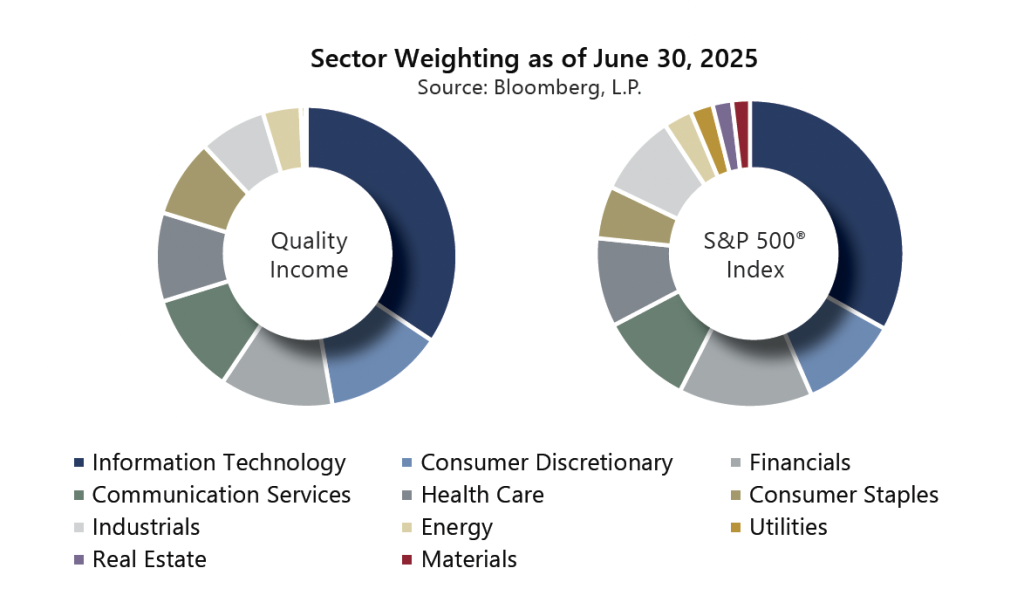

The strategy’s benchmark is the S&P 500® Index to ensure investors achieve the benefits of diversification without blindly omitting industries or large and/or impactful index holdings. It is a search for quality throughout the equity market, then an optimization to the quality leaders within as many sectors as possible. In instances where no quality names can be found in an industry, however, the strategy is then balanced through allocations elsewhere in the portfolio.

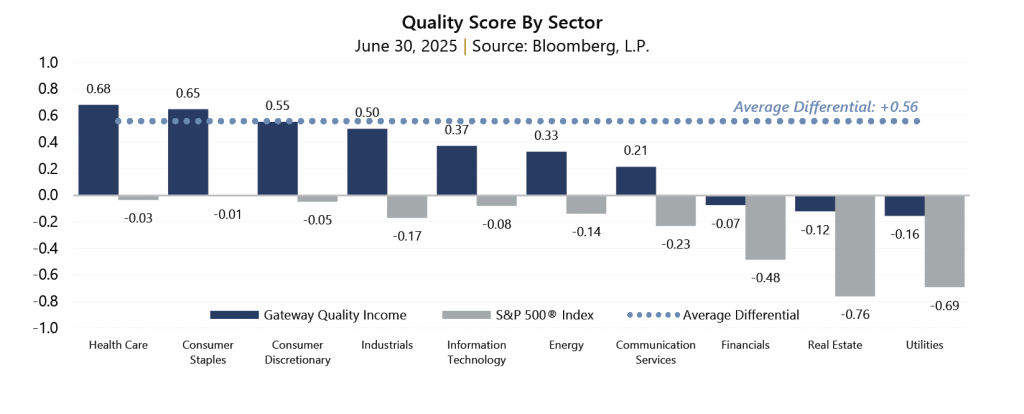

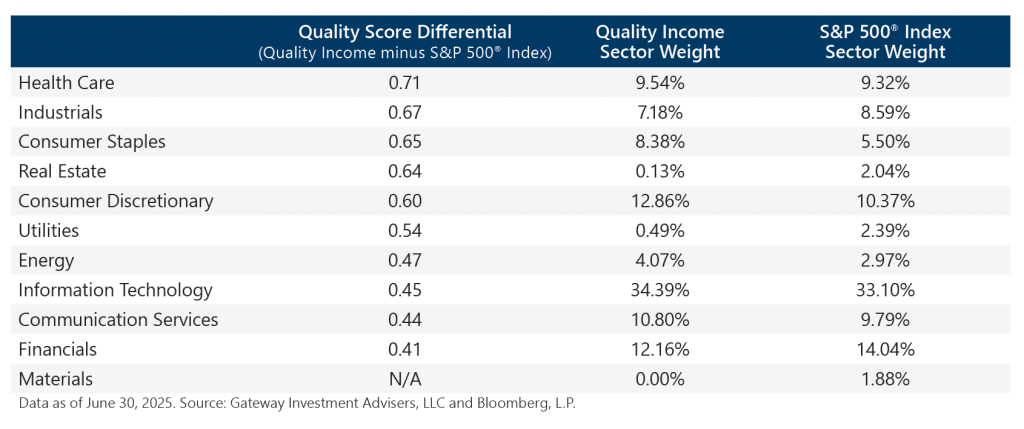

The results show a diversified portfolio with significantly higher quality scores than the broad market. Looking at relative quality scores at the sector level, Gateway’s Quality Income strategy has a higher quality score than the S&P 500®Index in all 10 of the Global Industry Classification Standard (GICS®) sectors to which the strategy has exposure. As of June 30, 2025, the strategy did not have any exposure to Materials.

Drilling down a bit more to individual company quality scores, Quality Income portfolio holdings rank in the 84th percentile relative to their respective industries, and 95% of the strategy’s equity portfolio ranks above the 50th percentile.

Finally, looking at various quality score inputs confirms the strategy has better quality metrics than its benchmark, the S&P 500® Index. In aggregate, when compared to the broad market, Gateway’s Quality Income strategy results in higher ROE and ROA, lower debt-to-equity and debt-to-asset ratios, higher cash flow from operations vs. debt, greater free cash flow to assets, and a better sales-to-enterprise value ratio.

Quality Applied

Investing in quality stocks may offer a powerful combination of defensive resilience and long-term growth potential and requires searching for high quality attributes across the broad equity market. This helps ensure diversification and avoids the omission of impactful index allocations.

Gateway’s quality optimization process uses a disciplined, quantitative approach to maximize profitability metrics while minimizing leverage. The result is an equity portfolio that maintains comprehensive market exposure with a decisive tilt towards companies with the potential for more durability and financial soundness.

Important Information

Past performance does not guarantee future results. Periods greater than one-year are annualized. Sources: Federal Reserve Bank of St. Louis, Bloomberg, L.P. and Morningstar DirectSM.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.