- Investors are facing many challenges and a new investment landscape. Equity valuations are lower, but not cheap, and volatility levels have shifted higher. On the flip side, on a real-return basis, bonds face their own challenges as interest rates are on the rise.

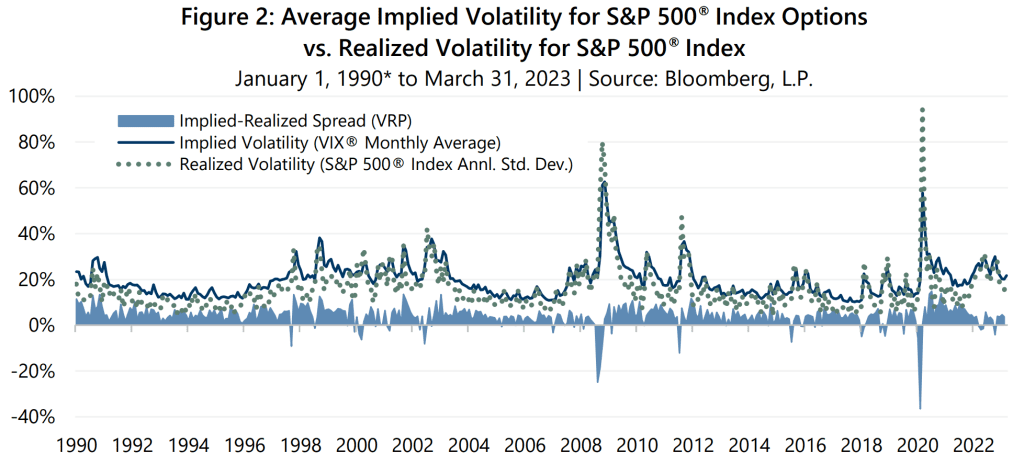

- By taking advantage of current interest rate and volatility dynamics, index options-based strategies that seek to benefit from the consistent overpricing of implied volatility, as seen in the Volatility Risk Premium (VRP), are showing the ability to generate meaningful cash flow for investors and a potential source of improved risk-adjusted return.

Like a simple two-sided coin toss, a sharp move in an investment one way or the other is almost certain to result in a winner and a loser. The rapid rise in interest rates that investors are grappling with is starting to provide a similar profile of potential outcomes. There is an old adage on Wall Street that suggests the Federal Reserve (the Fed) will raise rates until something breaks, which raises curiosity about those shadows lurking around the next decision by the central bank.

So far in 2023, investors are adjusting their portfolios given the reality of this new interest rate environment. Fixed income instruments may seem attractive on an absolute basis, however, once accounting for current inflation, real return expectations start to diminish as discussed in Real Return Conundrum. Using the price-to-earnings (P/E) ratio of the S&P 500® Index, equities still appear to be relatively expensive with a P/E of 18.5 at close of March 2023, compared to six months prior – when the same ratio was around 16.0. While corporations adjust to the growing number of challenges in a post-COVID world, the Fed has been committed to raising rates in an effort to tame inflation. Given the shift in market dynamics, investors now more diligently seek to answer the question “what can I expect from this investment?”.

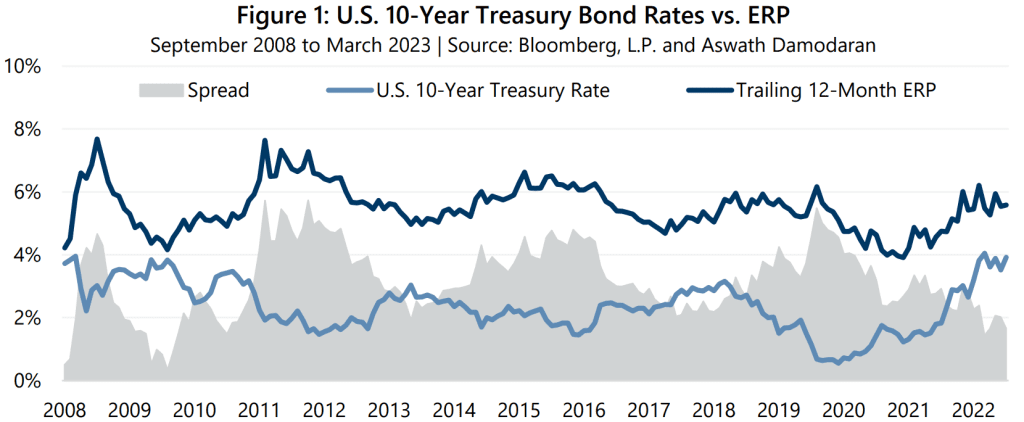

Figure 1 below shows the spread between Treasury Bond rates and the Equity Risk Premium (ERP). As shown in the grey area of Figure 1, this difference has compressed significantly since early-2020 as rates continue to rise. Going back to the end of 2008, the average spread between these two is 3.15% whereas current levels have now fallen below 2.0%. The “TINA” (there is no alternative) environment known to investors during the Quantitative Easing era is gone now, which has squeezed the spread between risk and riskless assets.

In a challenging environment, however, the VRP remains steady, and frequently above average. The VRP premium represents the difference between implied volatility, as measured by the average closing price of the Cboe® Volatility Index (the VIX®), and realized volatility, as measured by the standard deviation of daily returns for the S&P 500® Index. As shown in Figure 2, going back to the VIX® inception in January 1990 through March 2023, the VRP has been positive 89% of the time with an average of 4.1%.

Gateway’s investment philosophy holds that consistency is the key to long-term investment success and that generating cash flow through monetizing volatility, rather than seeking to forecast the rise and fall of the market, can be a lower risk means to participate in equity markets. Strategies that employ index option writing offer exposure to richly priced implied volatility and benefit from both higher levels of interest rates and implied volatility, creating the potential to generate attractive risk-adjusted returns over the long-term.

Past performance is no guarantee of future results.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.