Quality Revisited In a world full of uncertainty, the familiarity and durability offered by the quality factor is increasingly important for investors. While past results are no prediction of future outcomes, November 2023’s examination of the S&P 500® Quality Index versus the S&P 500® Value Index and the S&P 500® Growth Index determined that:

In a world full of uncertainty, the familiarity and durability offered by the quality factor is increasingly important for investors. While past results are no prediction of future outcomes, November 2023’s examination of the S&P 500® Quality Index versus the S&P 500® Value Index and the S&P 500® Growth Index determined that:

- Emphasizing quality within an equity portfolio may help investors harness the benefits of healthy firms exhibiting high-profitability, fortress balance sheets, and strong fundamentals.

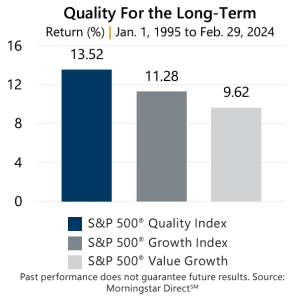

- Looking back to January 1995, the S&P 500® Quality Index outperformed the S&P 500® Value Index and the S&P 500® Growth Index with lower overall risk.

The factor debate continues, however, and offers the opportunity to further investigate the quality factor – represented by the S&P 500® Quality Index. The S&P 500® Quality Index is designed to track high quality stocks in the S&P 500® Index, selected based on quality score. The quality score for individual stocks is calculated using return on equity, accruals ratio, and financial leverage ratio.

Factoring In the Rest Beyond value and growth, minimum volatility and high dividend are factor-based approaches popular with investors. Minimum volatility can be represented by the S&P 500® Minimum Volatility Index, whereas high dividend can be represented by the S&P 500® High Dividend Index.

Beyond value and growth, minimum volatility and high dividend are factor-based approaches popular with investors. Minimum volatility can be represented by the S&P 500® Minimum Volatility Index, whereas high dividend can be represented by the S&P 500® High Dividend Index.

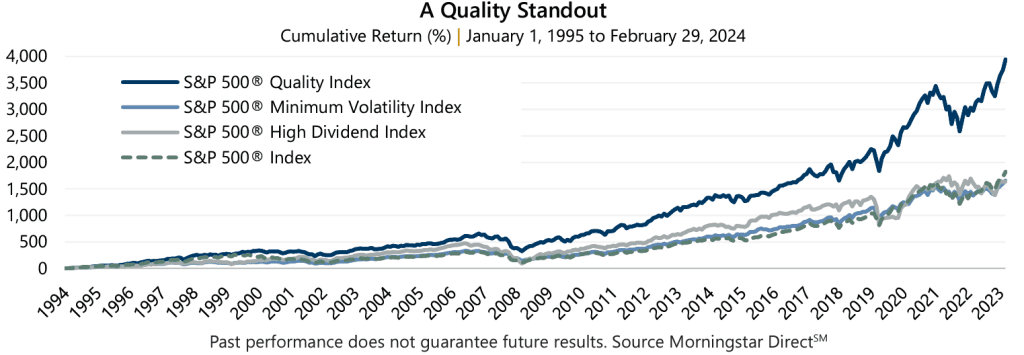

A quick look at performance since January 1995 shows quality outpaced both factors. From the start of 1995 through February 2024, the S&P 500® Quality Index had an annualized return of 13.52%, versus 10.32% for the S&P 500® Minimum Volatility Index, and 10.29% for the S&P 500® High Dividend Index. The broad market, as measured by the S&P 500® Index, returned 10.67% during this time period.

But Wait, There’s More

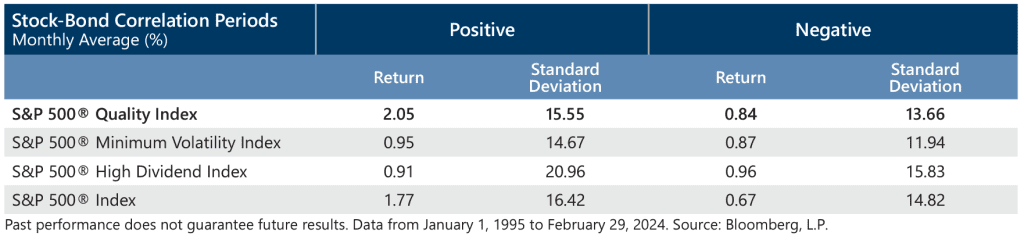

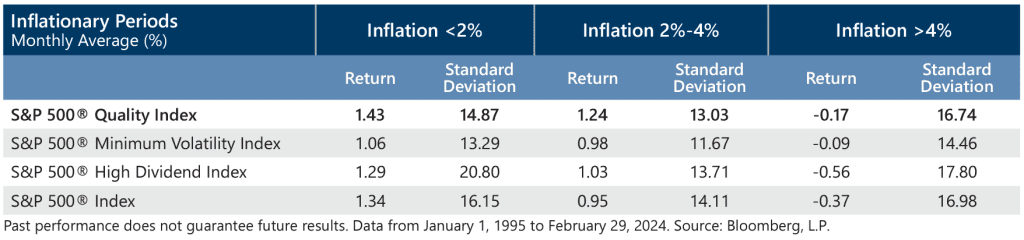

A deeper dive shows how quality has performed under varying stock and bond correlation and inflationary scenarios. Regardless of inflation or correlation between stocks and bonds, quality has routinely delivered relatively robust average monthly returns with lower risk than the broad market, minimum volatility, or high dividend factors. Below, data from the January 1, 1995 inception of the S&P 500® Quality Index shows the quality factor during periods of positive and negative stock-bond correlation as well as low, moderate, and high inflation regimes through February 29, 2024.

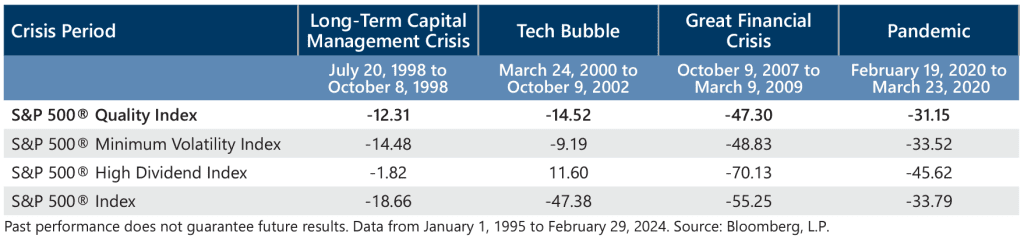

The quality factor has proven beneficial during rising markets and, importantly, also has offered protection during periods of uncertainty or market stress. The quality factor has historically added a layer of portfolio stability provided by durable businesses with a history of withstanding full economic cycles.

Emphasizing quality within an equity portfolio can help investors harness the benefits of healthy firms that exhibit high-profitability, fortress balance sheets, and strong fundamentals. The consistent application of a disciplined, active investment management process backed by an extensively experienced team can also add value for investors and improve outcomes in all environments. Since 1977, Gateway has developed a distinct expertise in quantitatively driven equity portfolio management paired with index option-based investing and currently offers a suite of products with the potential to mitigate risk and enhance risk-adjusted return.

Past Performance does not guarantee future results

Data sources: Morningstar DirectSM

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.