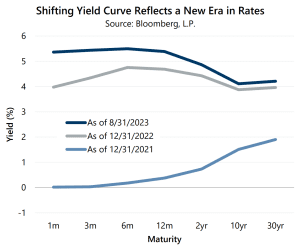

Higher Rates Lower Protection Costs Interest rates resumed their climb in August, after a reprieve in July, shifting the yield curve higher. For perspective, the 2-Year U.S. Treasury Note (the 2-Year) and the 10-Year U.S. Treasury Note (the 10-Year) ended August at 4.86% and 4.11%, respectively. These are levels not witnessed since 2007 for the 2-Year and since 2008 for the 10-Year. One might note that the 2-Year yield exceeds that of the 10-Year, not something seen in a typically upward sloping yield curve where, generally speaking, yields on shorter-term Treasury Bills are typically lower than longer-term Notes or Bonds. This relationship has been inverted since July 2022, and such an inversion has historically been a warning sign of recession. However, much uncertainty remains if or when such an event could actually occur.

Interest rates resumed their climb in August, after a reprieve in July, shifting the yield curve higher. For perspective, the 2-Year U.S. Treasury Note (the 2-Year) and the 10-Year U.S. Treasury Note (the 10-Year) ended August at 4.86% and 4.11%, respectively. These are levels not witnessed since 2007 for the 2-Year and since 2008 for the 10-Year. One might note that the 2-Year yield exceeds that of the 10-Year, not something seen in a typically upward sloping yield curve where, generally speaking, yields on shorter-term Treasury Bills are typically lower than longer-term Notes or Bonds. This relationship has been inverted since July 2022, and such an inversion has historically been a warning sign of recession. However, much uncertainty remains if or when such an event could actually occur.

Given the abundance of uncertainty surrounding the potential economic effects of recent monetary policy tightening and persistent inflation, portfolio protection may be on the minds of many investors. Investment strategies that combine equity market exposure with positive net cash flow may benefit from a new, higher rate environment. If the Federal Reserve does not return to a zero-interest rate policy, the interest rate component of written option strategies could persistently and positively contribute to return moving forward. For those that purchase put options as a source of defense, higher interest rates have helped lower the cost of protection.

Protection from Put Buying vs Short-Selling Equity Investors can mitigate downside risks on a single asset, or an entire portfolio, by purchasing a put option on the asset(s). In exchange for purchasing a put option, investors benefit from an increase in the option value if the underlying asset(s) declines and/or volatility increases. This has historically been a cost-effective way to benefit from an asset or equity market decline, similar to the payoff when short selling an asset. However, unlike short selling, when purchasing put options, the investors’ potential loss is capped at what they paid for the put.

Investors can mitigate downside risks on a single asset, or an entire portfolio, by purchasing a put option on the asset(s). In exchange for purchasing a put option, investors benefit from an increase in the option value if the underlying asset(s) declines and/or volatility increases. This has historically been a cost-effective way to benefit from an asset or equity market decline, similar to the payoff when short selling an asset. However, unlike short selling, when purchasing put options, the investors’ potential loss is capped at what they paid for the put.

When an investor sells an asset short, such as a stock, they immediately receive cash. One could safely deposit this newfound cash and reasonably expect to earn a yield similar to the 90-Day U.S. Treasury Bill (90-day T-Bill) rate, which was 5.32% at the end of August. This is an attractive yield in today’s market, but the risk of loss is unlimited should the price of the underlying asset rise.

Cost of Protection Declined in 2023

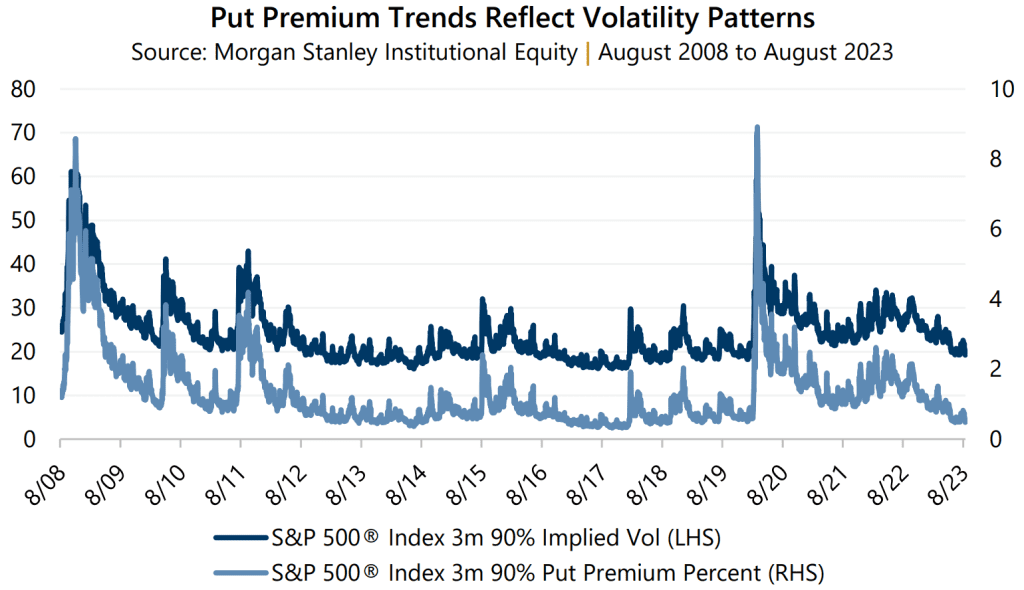

As interest rates on savings accounts, certificates of deposit, money market funds and other low-risk alternatives rise, safely deposited cash sounds much more appealing. Consider a comparison between today’s 90-day T-Bill rate versus 2.90% in August 2022 or 0.04% in August 2021. This higher opportunity cost of using cash to purchase put options is one factor contributing to lower prices. However, there is more to the story.

As a reminder, historically, option pricing has been highly correlated to levels of implied volatility. Put costs also declined in 2023 due to the settling of implied volatility. As volatility levels drifted lower during the summer, from a 2023 high of 26.52 in March to a low of 12.91 in June, the cost of protection decreased. Data from August 2008 to the start of September 2023 shows 3-month implied volatility was in the 30th percentile and the cost of index put options with exercise prices 10% out-of-the-money, or 10% below current market level, was in the 14th percentile.

A Time for Active Management

Gateway is a pioneer in using options to manage risk. Its active approach enables the ability to take advantage of fluctuating pricing dynamics and adapt to an evolving environment in real-time. Investors looking to participate in potential market advances with an eye on risk management may want to consider exploring active, options-based strategies to lower portfolio volatility.

Past performance is no guarantee of future results.

Data sources: Bloomberg, L.P. Federal Reserve Bank of St. Louis, and Morningstar DirectSM.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.