Despite concerns over inflation, Federal Reserve policy, imbalances in labor and raw materials markets and COVID-19 variants, the S&P 500® Index advanced 15.25% over the first half of the year. Additionally, equity markets have been relatively calm so far in 2021. The S&P 500® Index’s largest peak-to-trough decline for the first half of 2021 was only 4.13%, well below the -13.64% average annual intra-year maximum drawdown of the previous 40 years. What awaits investors in the second half of the year?

The historical record is a mixed bag for years in which the equity market posts a double-digit return in the first six months, which has happened 15 times in the last 40 years. On one hand, in nine of those 15 years, the S&P 500® Index also posted double-digit returns in the second half of the year. On the other hand, the average peak-to-trough drawdown of the S&P 500® Index in the final six months of those 15 years was -9.41%.

Given the mix of calm equity market conditions and strong returns, plus a laundry list of concerns in the background during the first six months of 2021, the adage of expecting the unexpected – including the potential for extreme outcomes at either end of the return spectrum – would seem to apply for the remainder of the year.

Other than calibrating expectations to accommodate a wide range of results, what can investors do to prepare for what lies ahead? In navigating the market’s ups and downs to come, there may be benefits to re-positioning portfolios to be less reliant on fixed income.

The Bloomberg Barclays U.S. Aggregate Bond Index (the Agg) has posted negative returns over the year-to-date and one-year periods ended June 30, 2021. If continued economic improvement helps drive the equity market higher in the second half of 2021, that may put upward pressure on interest rates, especially if recent inflation trends continue. This, of course, reduces the likelihood that fixed income returns turn positive.

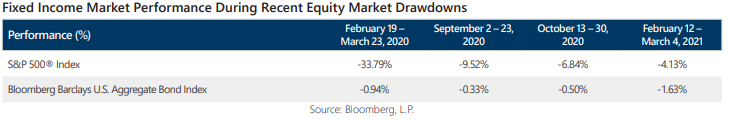

Many fixed income investors are comfortable with the tradeoff between subdued returns, when conditions are positive for risk taking, in exchange for potentially positive returns when risk taking is penalized. Unfortunately, the fixed income market has not held up its end of this bargain lately. As the table shows, the Agg delivered losses during the last four equity market drawdowns – even during 2020’s fastest bear market decline in history.

While the future remains uncertain, investors can count on the equity market to remain reliably unpredictable. Given recent results in the fixed income market, investors may well wonder what they can rely on it for. In this environment, investors may benefit from increasing allocations to strategies that use index options to deliver a low-volatility equity profile. These strategies have the potential for consistent participation in equity market advances while mitigating market declines. Index option-based low volatility equity may also have the potential for better long-term returns than fixed income in a low-to-rising interest rate environment. These strategies have been the focus of Gateway’s risk-first approach to long-term investing since its founding in 1977.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.