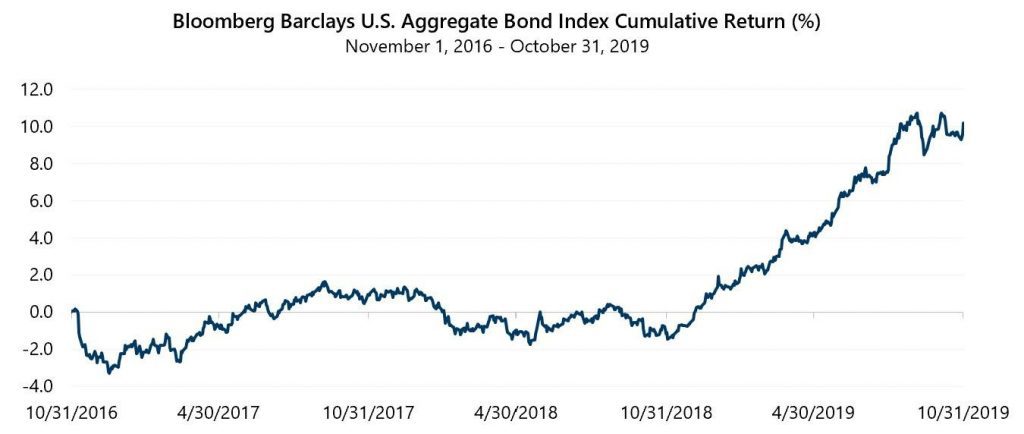

A quick check of recent bond market returns seems to indicate that all is well in the bond market. With the Bloomberg Barclays U.S. Aggregate Bond Index (the Agg) up nearly 9% through the first 10 months of 2019 and up over 11.5% over the trailing 12 months ended October 31, reports of the end of the multi-decade bull run in bonds appear to be premature. Or are they? Despite strong recent returns, the 3- and 5-year annualized returns of the Agg are just slightly above 3%. In fact, the cumulative 3-year return is lower than the trailing 12-month return. In other words, as seen in the following chart, the Agg had a negative return for the first two years of the current three-year period.

Source: Bloomberg, L.P.

Most of the positive bond market return in 2019 came within the first six months. Uncertainty over trade policy and concerns about a slowing global economic expansion drove expectations that the Federal Reserve (the Fed) would cut short-term interest rates, which in turn, helped drive longer-term rates down and bond prices up. Interestingly, as the Fed delivered on expected rate cuts, first in July and then again in September and October, the bond market’s rate of advance has slowed. In fact, the Agg lost nearly a quarter percent over the course of September and October.

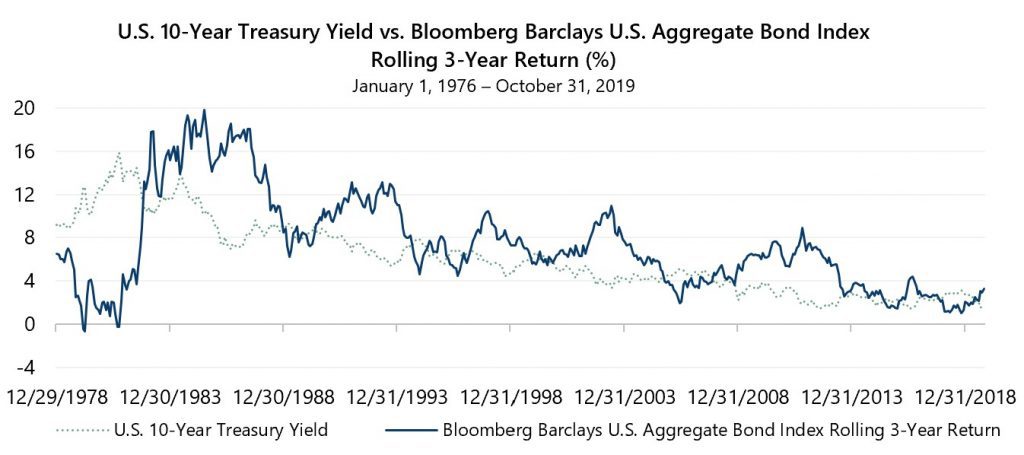

Investors may find it advantageous to prepare for potentially low returns from bond investments now that the Fed delivered on market expectations of three cuts in the Federal Funds rate and with bond futures market pricing reflective of declining probabilities of additional cuts. Specifically, without significant deterioration in economic conditions, bond yields could likely stay low or even rise, potentially resulting in a continuation of multi-year annualized returns that are too low to help many investors meet their long-term objectives.

Most of the positive bond market return in 2019 came within the first six months. Uncertainty over trade policy and concerns about a slowing global economic expansion drove expectations that the Federal Reserve (the Fed) would cut short-term interest rates, which in turn, helped drive longer-term rates down and bond prices up. Interestingly, as the Fed delivered on expected rate cuts, first in July and then again in September and October, the bond market’s rate of advance has slowed. In fact, the Agg lost nearly a quarter percent over the course of September and October.

Investors may find it advantageous to prepare for potentially low returns from bond investments now that the Fed delivered on market expectations of three cuts in the Federal Funds rate and with bond futures market pricing reflective of declining probabilities of additional cuts. Specifically, without significant deterioration in economic conditions, bond yields could likely stay low or even rise, potentially resulting in a continuation of multi-year annualized returns that are too low to help many investors meet their long-term objectives.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.