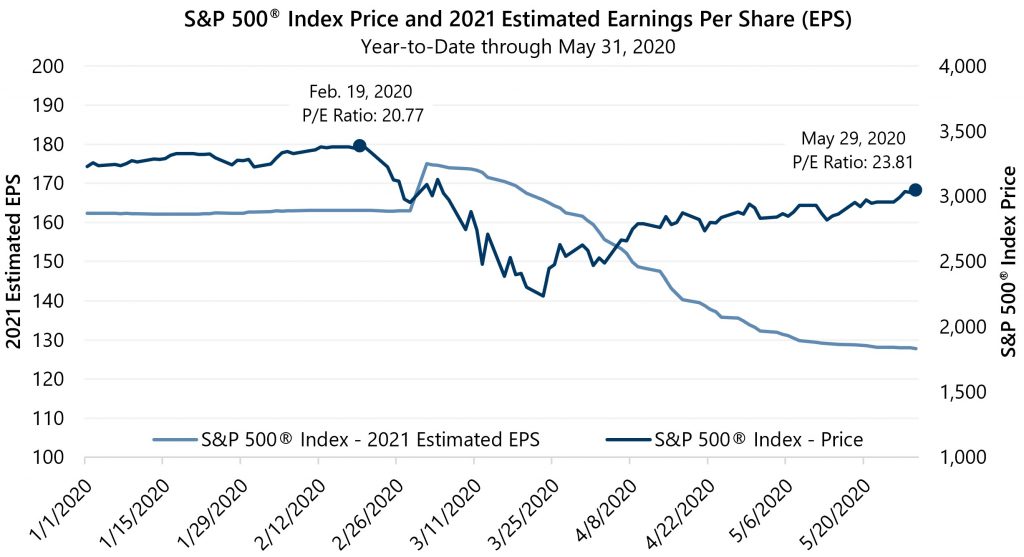

The S&P 500® Index has climbed over 35% from its 2020 low on March 23 and, as of May 29, was less than 10% below its February 19 all-time high. However, the robust – yet partial – market recovery may put investors in riskier circumstances than they faced earlier in the year. As the equity market has trended up, estimates of future corporate earnings (as measured by 2021 estimated earnings per share (EPS), have trended down. As a result, equity market valuation, as measured by price-to-earnings (P/E) ratio, is higher at the end of May than earlier in the year, prior to the market’s peak and subsequent plunge.

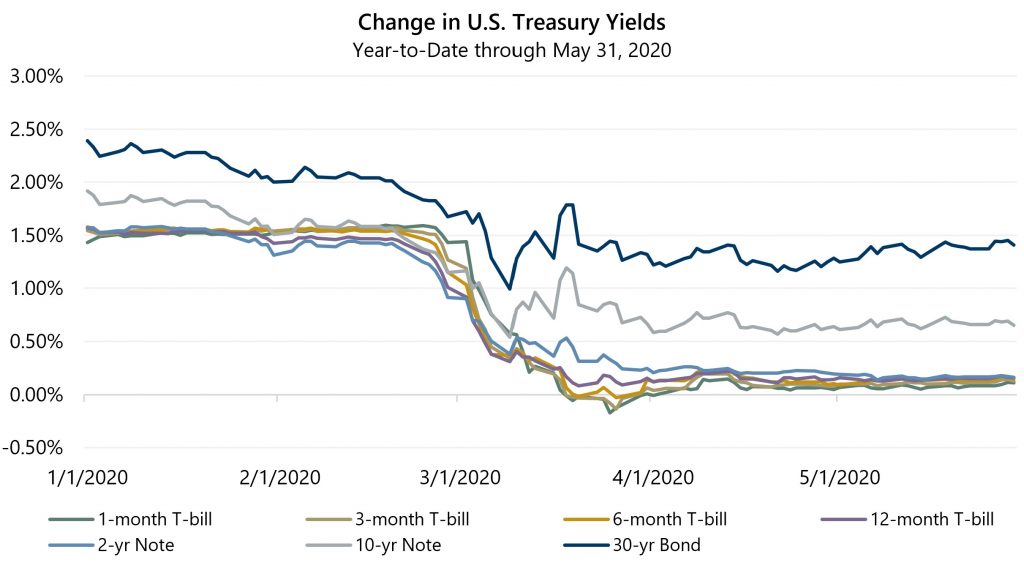

While the equity market’s upward trend has been welcomed and is encouraging, economic data is just starting to shed light on the extent of the carnage wrought by the COVID-19 virus mitigation efforts. It is too early to tell what the follow-on effects will be, what shape a recovery will take, or if new large-scale outbreaks and further economic damage are in store. Moreover, the conventional tool used by most investors to counteract equity market risk, high-quality fixed income investments, has a diminished capacity for meeting investor needs on this side of the equity market chasm. U.S. Treasury yields dropped precipitously in the first quarter and have stayed near all-time lows as the equity market has trended up in the second quarter of 2020.

Two forces may keep yields low for an extended time period. The minutes from the most recent Federal Reserve Open Market Committee (the Fed) meeting noted that they would maintain the current target range of 0% to 0.25% for the federal funds rate “until they were confident that the economy had weathered recent events and was on track to achieve the Committee’s maximum employment and price stability goals.” With the employment rate at double-digits for the first time in decades and no signs of inflation, the federal funds rate is unlikely to increase anytime soon. Indeed, the Fed meeting minutes noted that market participants “expected the target range for the federal funds rate to remain at the effective lower bound for the next couple of years.” Policy rates will continue to put downward pressure on longer-term interest rates until there is significant improvement in the employment picture.

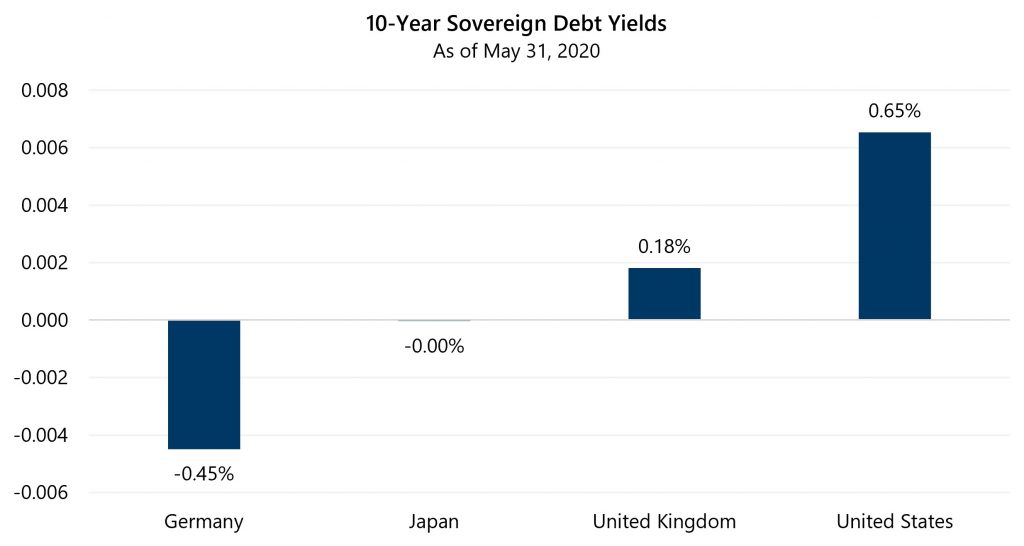

The other force likely to keep U.S. yields low is the even-lower yields on other developed-nation sovereign bonds. The 65 basis point yield on the 10-year U.S. Treasury note as of May 31, 2020 towers over the negative yields on 10-year issues from Germany and Japan, and the yield on the 10-year U.K. Gilt – which was just barely positive at the end of May. Comparatively high yields on U.S. government issues are likely to sustain strong demand from foreign investors, thus adding downward pressure on longer term domestic bond yields.

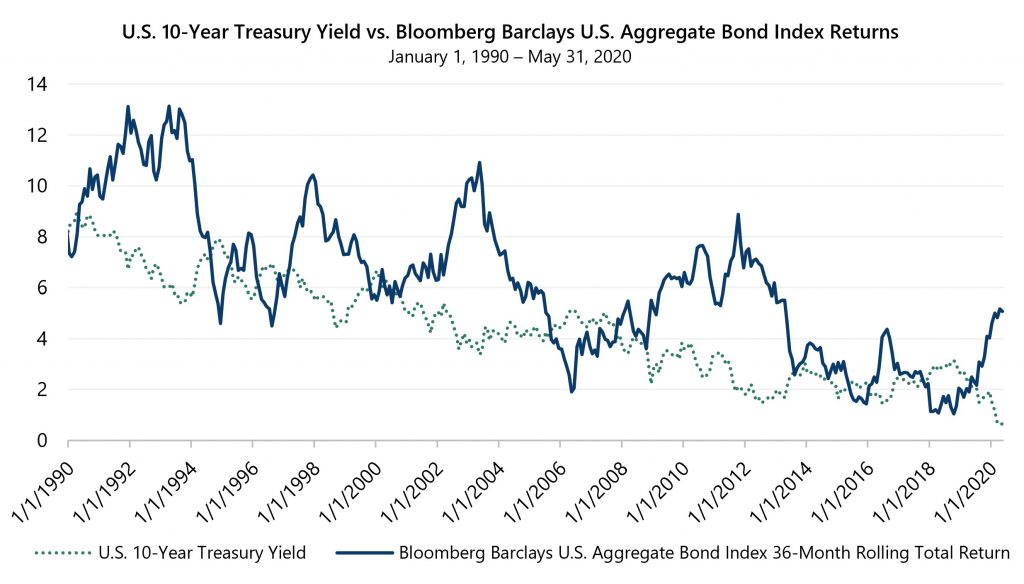

The plunge in yields has driven strong returns from the bond market in recent quarters, however, if rates stay low for an extended period of time, investors may see a return to the longer-term trend of lower multi-year returns from fixed income investments.

The equity market’s partial recovery is not evidence of less risky market conditions. Pandemic-related risks abound while renewed trade tensions with China and civil unrest across the nation have been added to the list of investor concerns. In the current low-yield environment, investors may benefit from supplementing fixed income allocations with other lower-volatility investments. With implied volatility levels still well above its long-term average, strategies that combine equity market exposure with cash flow from writing index options may be particularly attractive.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.