License to Kill, released in 1989 and starring Timothy Dalton as James Bond, is regarded by some as the worst Bond film ever made. New York magazine’s website, Vulture.com, which focuses on pop culture, describes License to Kill as a “…nasty little piece of work that’s so eager not to be a Bond film that … it basically winds up being nothing at all.” This sentiment may be similar to how some investors feel about their fixed income allocations recently. Yield, return and diversification characteristics have been so unlike what investors came to expect during the decades-long bond bull market that exposure to the asset class may leave some investors feeling empty in recent months.

While the S&P 500® Index followed up September’s loss with an October gain that set a new all-time high, the Bloomberg U.S. Aggregate Bond Index (the Agg) posted a loss for the third consecutive month. Moreover, the Agg has posted negative returns in six out of 10 months so far in 2021, including the two months (January and September) that the S&P 500® Index posted a loss.

The bond market’s recent struggle to generate gains regardless of equity market direction adds to a growing body of evidence that investor’s bond allocations may continue to face challenges in meeting the key objectives of yield, low-volatility total return and diversification. The yield and total return challenges faced by fixed income investments are relatively obvious. Despite the generally upward trend in yields on bonds with maturities of two years and longer over the past five quarters, yields on most bonds remain at levels that would have been labeled “historic lows” prior to the pandemic. Moreover, there is a strong relationship between yield levels and longer-term total return generated by fixed income portfolios. This relationship is illustrated by the persistent downward trend in multi-year annualized total return generated by a diversified bond market index like the Agg as interest rates have trended down over the last four decades.

The diversification challenges of fixed income are a bit harder to detect and are best illustrated by the Bloomberg Long-Term U.S. Treasury Index (the TLT). Many investors, particularly institutions, turn to long-term U.S. Treasury investments for diversification and their historical potential to function as a nearly ideal hedge to equity market risks. The profile of the ideal hedge is an investment that generates low volatility returns that are consistently positive and delivers significant positive returns when the equity market delivers large losses.

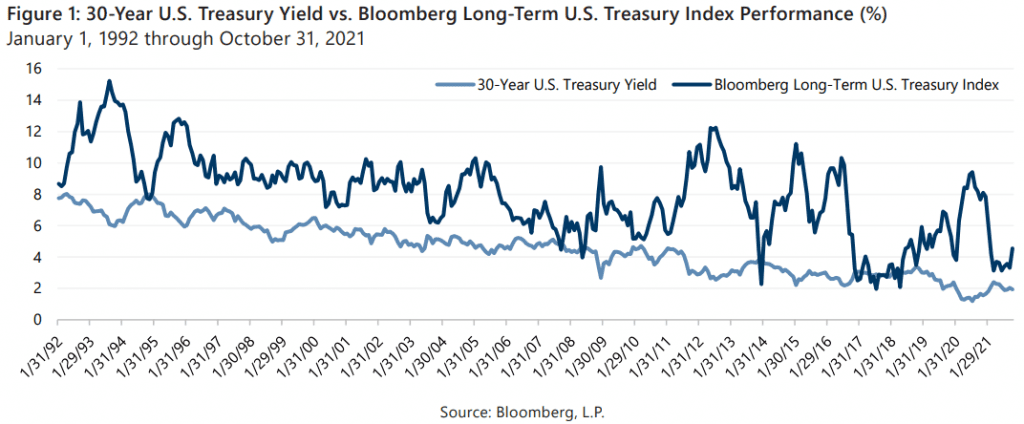

The TLT fit the profile of the ideal hedge until about 2006. October 2006 was the first time in over 20 years that the TLT had posted a five-year annualized return of less than 6%. Since then, five-year annualized returns for the TLT have been below 6% more than 40% of the time, and below 4% more than 16% of the time, including one five-year period of sub-2% annualized return. As Figure 1 shows, as the yield on the 30-Year U.S. Treasury has trended down, the five-year annualized return for the TLT has become more variable and the low-end of the return range has also trended down.

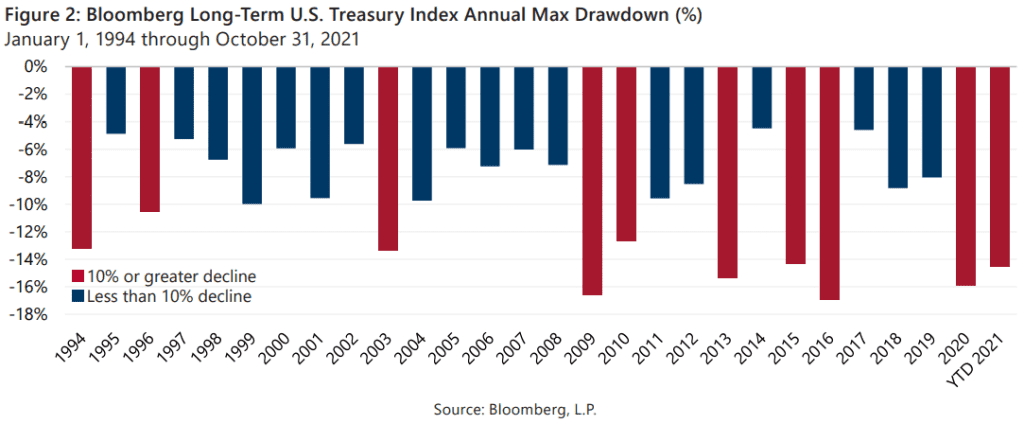

While low but positive returns may be acceptable to some investors seeking a diversifying hedge, one characteristic that is undeniably undesirable in a hedge is significant losses on a frequent basis. As long-term Treasury yields have come down, the TLT has incurred double-digit drawdowns with increasing frequency. As Figure 2 shows, the maximum intra-year drawdown for the TLT exceeded 10% in seven of the past 13 years, but this happened only three times in the preceding 15 years. The S&P 500® Index, in comparison, has only had six intra-year drawdowns that have exceeded 10% over the last 13 years.

In short, bonds alone may no longer be sufficient to successfully navigate the Casino Royale that the equity market may feel like to investors at times. The increased frequency of low multi-year annualized returns and large drawdowns has reduced the effectiveness of long-term fixed income as a risk-reducing diversifier. Due to the mathematical relationship between index option price changes and equity index price changes, written index call options and purchased index put options are a potentially reliable source of gains during equity market declines. Risk-management strategies that employ one or both techniques may be a compelling compliment to, or replacement of, fixed income for investors seeking a reliable hedge to equity market volatility.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.