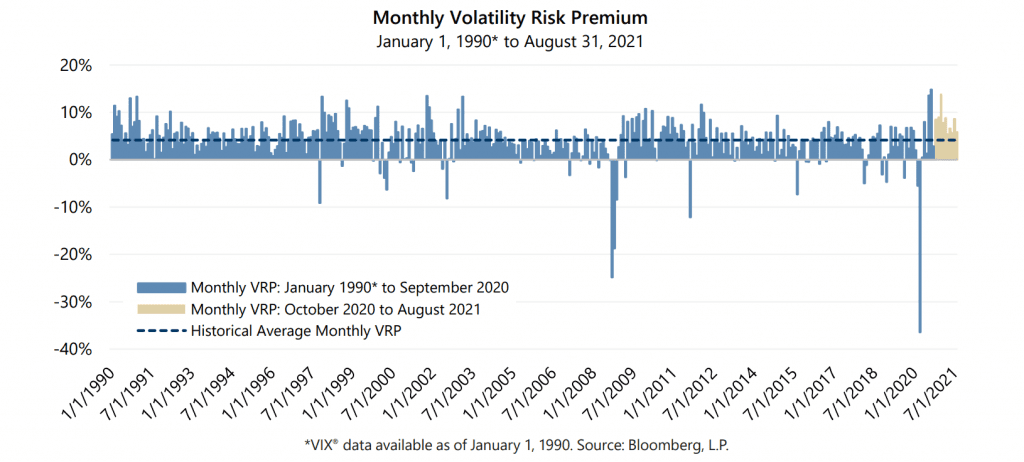

S&P 500® Index option buyers continued to overpay by an above-average amount based on the unusually high Volatility Risk Premium (VRP) that has persisted during the equity market’s strong recovery and advance from lows set during Q1 2020. August VRP, measured by the difference between the standard deviation of daily returns for the S&P 500® Index and average closing price of the Cboe® Volatility Index (the VIX®) over the course of the month, came in at over nine percentage points. August’s VRP was more than double its historical monthly average and it marked the 11th consecutive month of above-average readings, the third longest such streak in history and the longest in more than a decade.

What accounts for the unusually high VRP? While it is difficult to know with certainty, pricing for the VIX® appears to reflect potential risks such as inflation and the economic impacts of spreading COVID variants, while low correlation across individual stocks has put a damper on realized volatility. The dynamics on both sides of the VRP equation have been in-play for several months. On the implied volatility side, the persistence of the pandemic and its economic impacts are helping sustain demand for options and option-based hedges. Meanwhile, realized volatility has largely been a function of the equity market processing the day-to-day fluctuations of changing short- to intermediate-term prospects for the broad grouping of “stay-at-home” versus “reopening” stocks.

The current streak of above-average VRP has overlapped with a period of remarkable equity market resilience as investors have faced the uncertainties created by the pandemic. Through August 31, 2021, the S&P 500® Index has more than doubled in value since its closing value on March 23, 2020. On a year-to-date basis, it has advanced 21.58% with below-average standard deviation and a maximum drawdown of only 4.13%, which is less than 30% of the average intra-year maximum drawdown over the last 30 years.

Investors who anticipate that recent equity market tranquility is temporary may want to consider index option writing strategies to reduce market exposure and lower risk. Strategies that seek to maintain equity market correlation while delivering consistently lower risk may be an appealing way to participate in a possible continuation of the equity market’s advance while avoiding a portion of the downside in the event the market changes course.

Investors with a more sanguine outlook may find the absolute return and risk-adjusted return potential of index option writing strategies appealing relative to other lower volatility investments. A possible continuation of richer-than-normal option pricing combined with low realized volatility creates the potential for index option writing strategies to deliver attractive risk-adjusted returns with lower-than-normal volatility. In the current environment of low interest rates with the potential to rise over time, there are possible advantages to seeking returns through allocations to index option writing strategies. If low or rising interest rates keep bond market returns depressed, diversified investors may benefit from investments that do not have interest rate sensitivity.

In either application, index option writing exposure to richly-priced implied volatility has the potential to generate attractive risk-adjusted returns over the long-term.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.