From the January 1, 1990 inception of the Cboe® Volatility Index (the VIX®) to November 17, 2023, the popular measure of implied volatility has averaged 19.60. However, during the recent quantitative easing era, investors experienced prolonged periods with the VIX® at or near historic lows. In fact, the VIX® recorded an all-time low in November 2017 when it closed at 9.14. Fast forward six years, on November 17, 2023, the VIX® closed at 13.80 with a 2023 year-to-date average of 17.39. A review of its more than 30-year history suggests current implied volatility levels are much more “normal.” Given the uncertainty surrounding current global events and macroeconomic forces, there appears to be an abundance of factors that might continue to support the VIX® at 2023 levels or drive it higher.

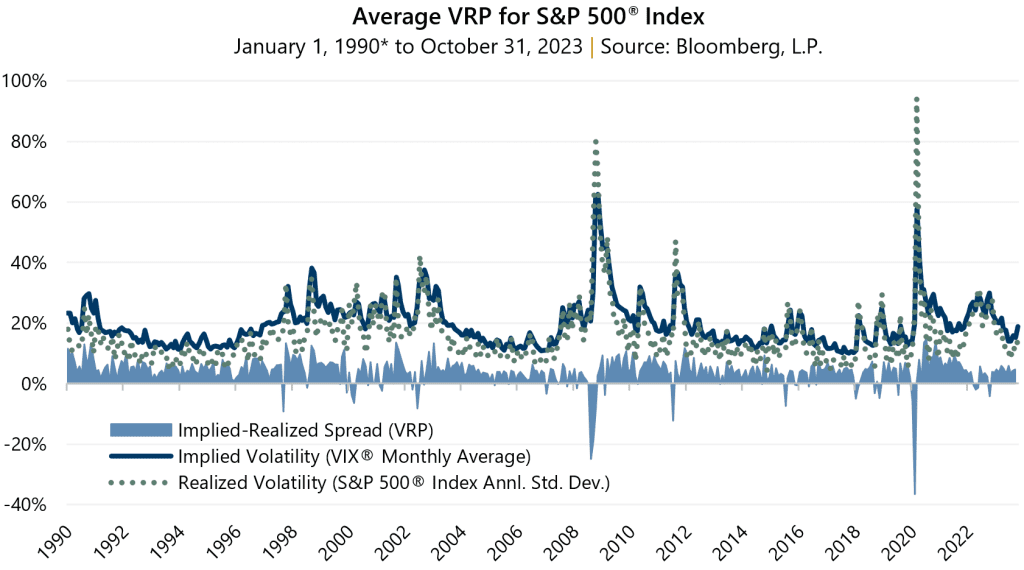

The VIX® ended September at 17.52 before reaching an intra-month low of 16.09 on October 11. As the equity market softened, the VIX® climbed to an intra-month high of 21.71 on October 20 before closing the quarter at 18.14. During October, the VIX® averaged 18.89 and exceeded realized volatility by 4.76 percentage points. This was consistent with its typical relationship, where average implied volatility exceeds realized volatility, as measured by the standard deviation of daily returns for the S&P 500® Index, which was 14.12% in October.

The over-pricing of implied volatility relative to realized volatility, known as the volatility risk premium (VRP), represents the potential for option-writing strategies to enhance risk-adjusted return relative to broad equity market indexes. Since the VIX® inception, this premium has been positive nearly 90% of the time and has averaged 4.08 percentage points. October’s VRP was well above the long-term average, as was the 2023 year-to-date average through October, which was 4.43 percentage points.

Gateway believes strategies that reduce risk and access this persistent premium through the use of index options can be an effective solution to the unique and ever-changing challenges that investors face in today’s markets. Equity market exposure combined with index options, and their associated VRP, can mitigate equity market losses while simultaneously benefitting from the equity market’s propensity to rise over the long term.

Past performance does not guarantee future results. Source: Bloomberg, L.P.