The S&P 500® Index returned 4.76% for the month of May, bringing its year-to-date return to -4.97%. As economic data continued to reflect COVID-19 related deterioration, the S&P 500® Index oscillated in the beginning of May, declining 3.08% between May 1 through May 13. With better-than-expected news surrounding the spread and severity of the virus, along with portions of the domestic economy reopening, the S&P 500® Index climbed 8.09% from May 13 through month end. The S&P 500® Index has climbed 36.59% since its March 23, 2020 low. From its all-time high on February 19, 2020, the S&P 500® Index remains down 9.56%.

The macroeconomic effects of COVID-19 were made clear from the data released in May. The second estimate of Gross Domestic Product growth for the first quarter of 2020 was -5.0%, slightly worse than the consensus estimate of -4.8%. Jobless claims were filed by 20.5 million people in April, leading to a 14.7% unemployment rate. The April labor participation rate extended its decline, dropping from 62.7% to 60.2%. The April Consumer Price Index, released on May 12, reflected just a 0.3% year-over-year increase, at the bottom of consensus expectations for the second consecutive month. With nearly 97% of companies reporting, first quarter aggregate operating earnings were on track to decline 11.65% quarter-over-quarter and 9.30% year-over-year, yet more than 70% of the companies that have reported earnings met or exceeded analyst estimates.

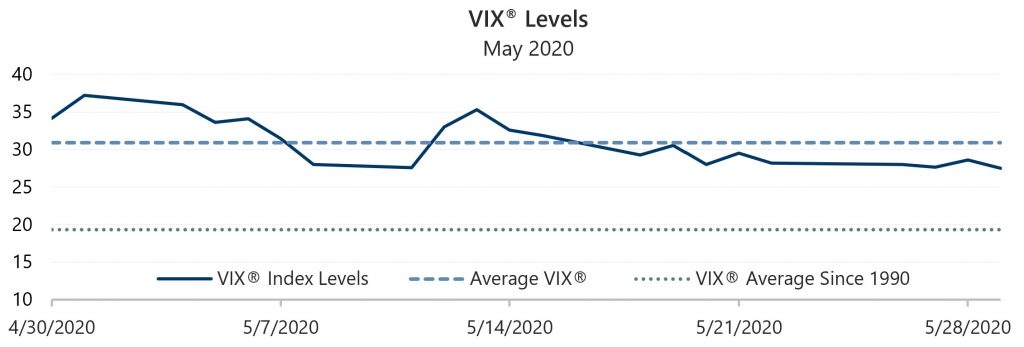

Implied volatility, as measured by the Cboe® Volatility Index (the VIX®), averaged 30.90 in May. Average implied volatility exceeded realized volatility, as measured by the standard deviation of daily returns for the S&P 500® Index, which came in at 22.95% for the month. In a continued moderation from extreme levels witnessed in March and early April, the VIX® generally declined throughout the month. The VIX® opened the month at 37.19, its high for the month, before drifting to an intra-month low of 27.51 on May 29.

Source: Bloomberg, L.P.

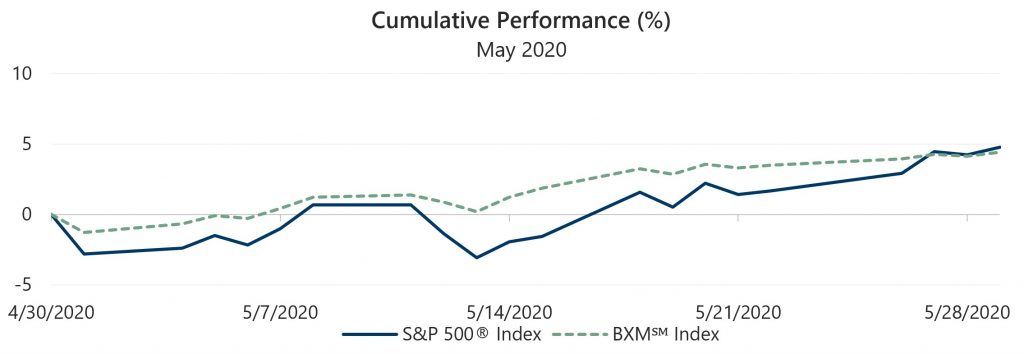

The Cboe® S&P 500 BuyWriteSM Index (the BXMSM) returned 4.43% in May, underperforming the S&P 500® Index by 33 basis points (bps). On the third Friday of each month, the BXMSM writes a new index call option as the option it wrote the previous month expires. The premiums the BXMSM collects on its written index call options have significant influence on its return potential over a period when the market advances and help to mitigate market declines. After providing significant downside protection during the market decline in early May, the BXMSM underperformed the S&P 500® Index during the strong market advance over the second half of the month. From the beginning of the month through May 13, the BXMSM returned 0.20% as the premium it collected in April more than offset the 3.08% decline of the S&P 500® Index over the same period. From its closing value on May 13 through month-end, the BXMSM returned 4.22%, underperforming the 8.09% return of the S&P 500® Index by 387 bps. On May 15, the BXMSM wrote a new index call option with a June expiration as its May option expired. The premium collected on the new index call option as a percentage of the BXM’sSM underlying value was 3.50%. The premium collected did not provide enough return potential to keep pace with the equity market’s advance over the last two weeks of the month.

Source: Bloomberg, L.P.

Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results.

The Bloomberg Barclays U.S. Aggregate Bond Index returned 0.47% in May. The yield on the 10-year U.S. Treasury Note (the 10-year) was relatively rangebound in May, starting the month at an intra-month low of 0.61% before reaching an intra-month high of 0.73% on May 18. The 10-year then drifted lower and closed the month at 0.65%.

1The BXMSM is a passive total return index designed to track the performance of a hypothetical buy-write strategy on the S&P 500® Index. The construction methodology of the index includes buying an equity portfolio replicating the holdings of the S&P 500® Index and selling a single one-month S&P 500® Index call option with a strike price approximately at-the-money each month on the Friday of the standard index-option expiration cycle and holding that position until the next expiration.