Apart from the spike associated with the Silicon Valley Bank led banking crisis in March 2023, volatility, as measured by the Cboe® Volatility Index (the VIX®), has been on a slow but steady decline so far this year. Relatively resilient corporate earnings, a softening macroeconomic environment and lower levels of inflation have fueled hopes that the U.S. Federal Reserve would slow, or pause, its rate of monetary tightening and interest rate increases. With this as a backdrop, the year-to-date average level of the VIX® through the end of April is 20.03. This is above its long-term average of 19.67 and well above the average of the decade that included the Quantitative Easing (QE) era of 16.86.

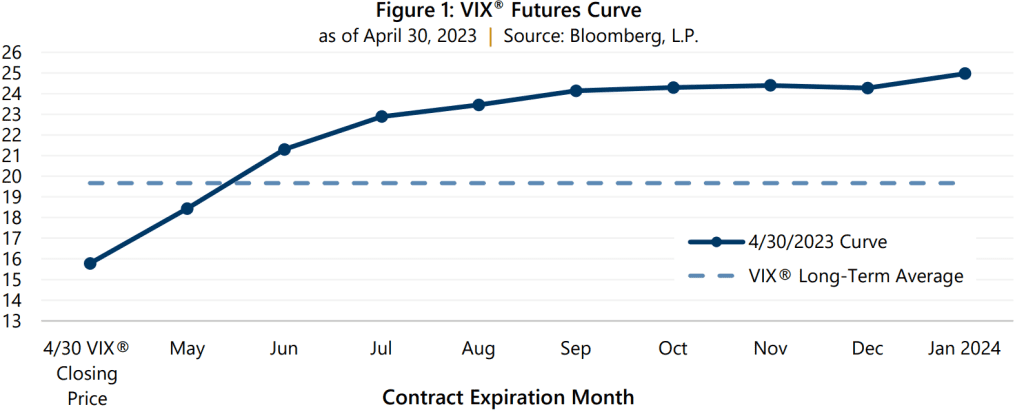

While some commentators may point to the VIX® decline as an “all clear” sign for investors, a closer examination reveals slightly more complexity. As of the end of April, the trailing 12-month VIX® average was 23.99. Though both implied and realized volatility have slightly declined this year, the spread between the two measures, or the Volatility Risk Premium (VRP), has been on an uptrend. As illustrated in Figure 1, there is an expectation that the 2023 volatility environment will be consistent with the past few years. Specifically, as the VIX® futures curve suggests, above-average implied volatility may continue and, if it does, attractive VRP may continue as well.

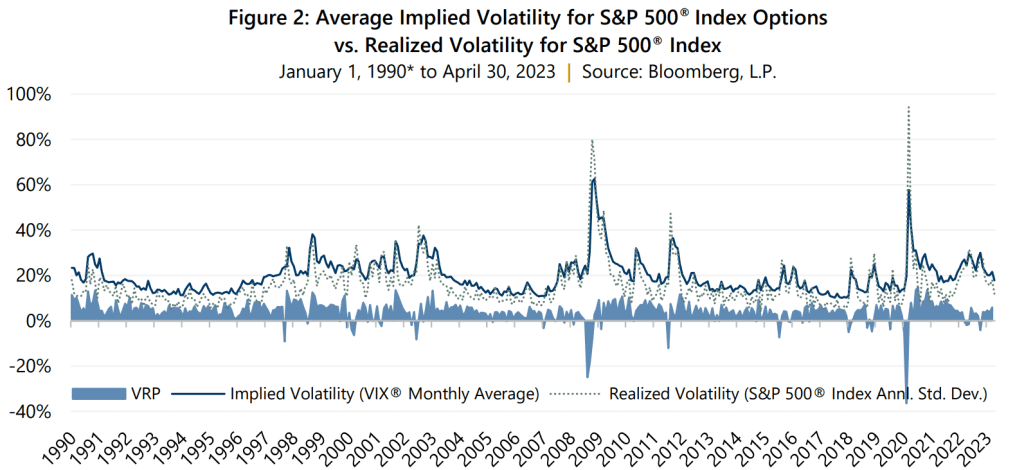

Going back to the inception of the VIX® in 1990, the average VRP, as represented by the blue shading in Figure 2, has been 4.08%. Even with the absolute levels of both implied and realized volatility declining recently, the VRP for the month of April was 5.87%, around 44% above the long-term average. As discussed in “Away from Zero,” interest rates beyond zero in conjunction with persistently elevated levels of volatility are beneficial to strategies that seek to be cash flow positive through the selling of index-based call options, such as those offered by Gateway.

Gateway has historically helped investors navigate through markets during periods of unexpectedly high volatility and periods of unexpectedly low volatility. While Gateway’s strategy benefits from a positive VRP, which is the case 89% of the time, the active and disciplined approach has successfully maintained consistent market exposure and risk profile during periods of low or negative VRP (i.e., when realized volatility exceed implied volatility). Whatever the balance of 2023 may bring, Gateway remains committed to its steady approach that has, for over 45 years, assisted clients in their pursuit of long-term returns with lower risk than the equity market.

1: Janaury 1, 2010 through December 31, 2019. Past performance is no guarantee of future results.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.