January 2024 Volatility Briefing

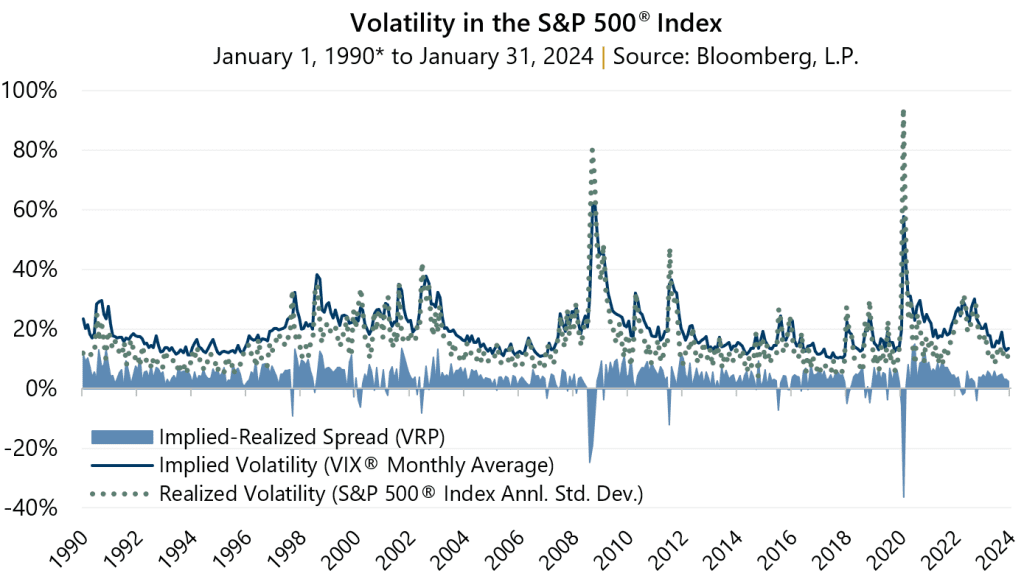

The equity market climbed to all-time highs in January while the Cboe® Volatility Index (the VIX®) ascended from the 2023 low of 12.07 on December 12. The VIX® averaged 13.39 in January with an intra-month low of 12.44 on January 11. Shortly thereafter on January 17, the VIX® jumped nearly 19% to an intra-month high of 14.79 before closing January at 14.35. Realized risk, as measured by the standard deviation of daily returns, was 11.03% for the S&P 500® Index in January.

January’s 2.36 percentage point spread between average implied and realized volatility, also known as the Volatility Risk Premium (VRP), was below its long-term average of 4.07. January was the fourteenth consecutive month that the measure has been positive. Such a stretch has not occurred since a 24-month run from April 2020 to March 2022. Prior to this pandemic-era streak however, one must look back to a 16 month stretch from October 2016 to January 2018.

A positive VRP is the norm, however. When looking back to the January 1990 inception of the VIX®, implied volatility has exceeded realized volatility over 89% of the time. Instances such as in November 2022, when the S&P 500® Index had multiple large single day moves that contributed to a reversal in the typical relationship, show realized volatility can exceed implied volatility but are the exception rather than the rule.

The over-pricing of implied volatility relative to realized volatility, or the VRP, represents the potential for option-writing strategies to enhance risk-adjusted return relative to broad equity market indexes. Gateway believes strategies that access this persistent premium through the use of index options can be an effective solution to the unique and ever-changing challenges that investors face in today’s markets. Equity market exposure combined with index options can mitigate equity market losses while simultaneously benefitting from the equity market’s propensity to rise over the long term.

Past performance does not guarantee future results. Source: Bloomberg, L.P.