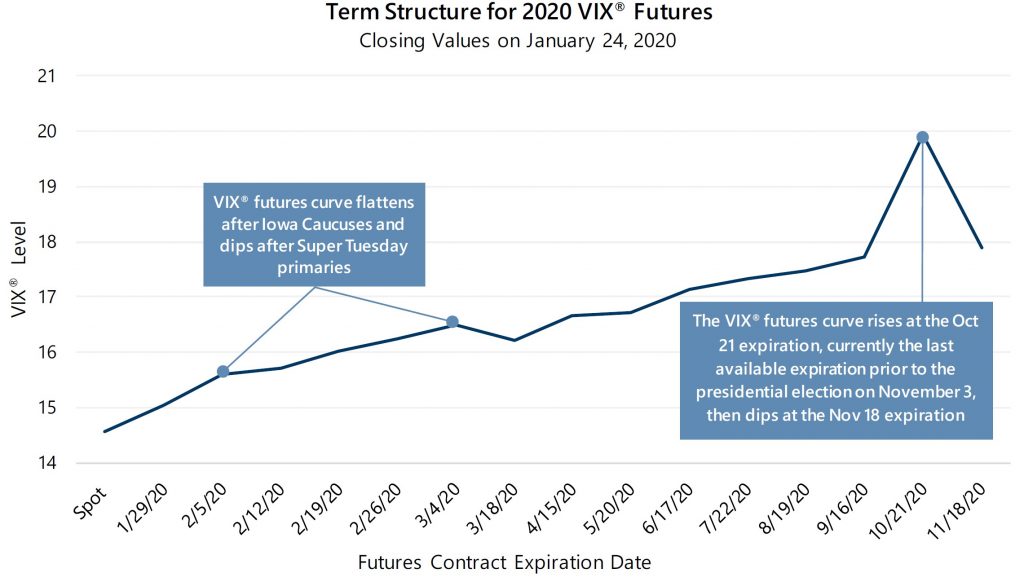

Volatility markets began to reflect possible election-year uncertainty in January. As the chart below shows, the VIX® futures contracts expiring near key election dates priced in investor expectations of higher volatility levels. The basic shape of the VIX® futures curve in late January was typical – it is usually upward-sloping when the current market price, or spot price, is below-average. However, the slope of the futures curve is steeper prior to the contract expiration dates of February 5, March 4 and October 21, and the slope flattens or declines between these expiration dates and the expirations that follow them. In other words, the changes in the VIX® futures curve after contracts associated with the Iowa Caucuses, Super Tuesday and the last expiration prior to the general election, demonstrate that market participants are anticipating the potential for an uptick in equity market volatility before or immediately after these election events.

Source: Bloomberg, L.P.

When volatility-linked instruments like index options reflect unique or anomalous amounts of volatility at different expiration dates, i.e. when volatility pricing varies in an unusual way across term structure, it can create a tactical advantage for active strategies over passive ones. Active index option strategies, like those managed by Gateway, can make active adjustments to index option positions in advance of their respective contract expirations, and contracts with higher implied volatility levels create the opportunity to increase option writing cash flow while potentially avoiding a change in strategy risk profile. Passive or systematic strategies that adhere to rules dictating strike price, expiration date and holding period may not be flexible or adaptive enough to benefit from such pricing anomalies.

Will election uncertainty lead to higher equity market volatility? Will surprise outcomes during the primaries or the general election cause large moves in the equity market? As always, Gateway will take a wait-and-see approach rather than try to anticipate the outcome of events and market direction. Our risk-first approach is focused on keeping the risk profiles of our strategies as consistent as possible. We seek to identify and take advantage of opportunities within our risk-management framework to increase net cash flow from index option writing. As 2020 unfolds, Gateway’s investment team will be vigilantly monitoring option markets for such opportunities whether they be driven by election dynamics or other phenomena.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.