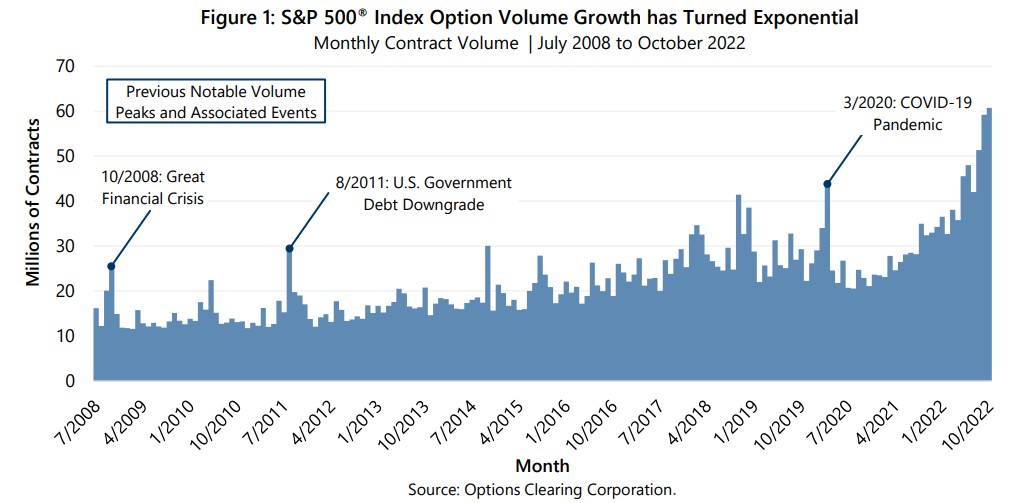

Trading volume in S&P 500® Index option contracts set a record in October 2022. As Figure 1 shows, trading volume in options on the bellwether equity index has been trending up for many years and has historically seen sharp increases in times of market stress. So, a record is not that much of a surprise.

On the other hand, October marked the sixth consecutive month of monthly trading volume that set a new record, an unprecedented streak that warrants examination. After reaching a pandemic-era low in August 2020, the growth trend in monthly trading volume has turned exponential. What is driving this change? Growing utilization of S&P 500® Index and other volatility-linked derivatives may be driven by a combination of the following:

- Demand for volatility-reducing hedges in an equity market environment that has had persistently higher volatility than levels typically seen over several years prior to the pandemic

- Volatility hedging by dealers and market makers in options for individual securities, which have seen periods of significant growth in the pandemic era

- The end of Federal Reserve quantitative easing, which had been a policy that likely contributed to persistently low equity market volatility for several years and dampened demand for volatility reducing hedges

- A move away from fixed income for risk reduction due to rising interest rates

There is another, newer phenomenon, that is also contributing to the growth in trading volume. There has been significant growth in ultra-short-term S&P 500® Index option trading – specifically, options that have one-day or less until they expire. S&P 500® Index options that are within one day of expiration have increased from approximately 30% of daily trading volume at the beginning of the year to over 50% for most of the third quarter of 2022. In other words, as much as half of October’s record volume may have been due to activity in these “zero days to expiration” (0DTE) strategies, as they are known.

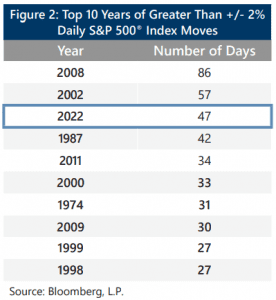

Growth in short-term S&P 500® Index options may be contributing to the high frequency of large one-day and intra-day market swings this year. Through October, there have been 47 days in 2022 when the S&P 500® Index has had a daily price change in excess of +/- 2%, already placing 2022 third in the ranking of years with the highest number of such moves since 1950 (see Figure 2). During the first two weeks of October alone, the S&P 500® Index moved up or down over 2% on half the days (five out of ten) and had an intra-day move of over 5% on October 13.

Growth in short-term S&P 500® Index options may be contributing to the high frequency of large one-day and intra-day market swings this year. Through October, there have been 47 days in 2022 when the S&P 500® Index has had a daily price change in excess of +/- 2%, already placing 2022 third in the ranking of years with the highest number of such moves since 1950 (see Figure 2). During the first two weeks of October alone, the S&P 500® Index moved up or down over 2% on half the days (five out of ten) and had an intra-day move of over 5% on October 13.

Should investors be concerned about the potential market impact of rising index option trading volume in general, and 0DTE trading strategies in particular? It is worth noting that if 0DTE strategies have driven market volatility up, it would not be the first time that a new trading strategy has had such an impact on the market. High frequency trading circa 2010 and “meme stock” trading early in the pandemic are recent examples.

The potential market impact of 0DTE is a double-sided coin. On one side, index option strategies may be exacerbating the market’s tendency to have significant price swings during bear markets and other periods of uncertainty. On the other side, large price swings are contributing to elevated implied volatility and, therefore, elevated index option premiums, which can be a benefit to strategies that generate option-writing cash flow.

Investing in the equity market entails risks—at any given time the specific mix of risk factors typically includes a blend of the familiar and novel. Tightening monetary policy is a familiar risk factor in the current mix. The potential impact of ultra-short-option trading strategies is a novel risk factor. Investors who need to maintain equity market exposure to meet their long-term investing goals may be able to benefit from the impact these risk factors have on implied volatility levels.

Investment strategies that combine equity market exposure with cash flow from writing index options, like Gateway’s, have the potential to reduce equity market risk and may benefit from higher implied volatility. Higher implied volatility has the potential to result in higher cash flow from index option writing which, in turn, may improve such strategies’ return potential if the equity market climbs, while also enhancing their potential downside protection if the equity market declines. As always, Gateway will take advantage of the opportunities in the current environment while helping investors stay committed to their long-term goals.

Past performance is no guarantee of future results.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.