A once-reliable asset class for yield, low-volatility total return, diversification and risk reduction, bonds have struggled to deliver on any of these measures recently.

- Real yields on U.S. Treasuries are negative at all maturities.

- The Bloomberg U.S. Aggregate Bond Index (the Agg) ended the first quarter of 2022 with a larger loss than the S&P 500® Index, and negative returns over the trailing one- and two-year periods.

- The Agg has posted negative monthly returns in 13 of the last 24 months, including six of seven months in which the equity market return was negative.

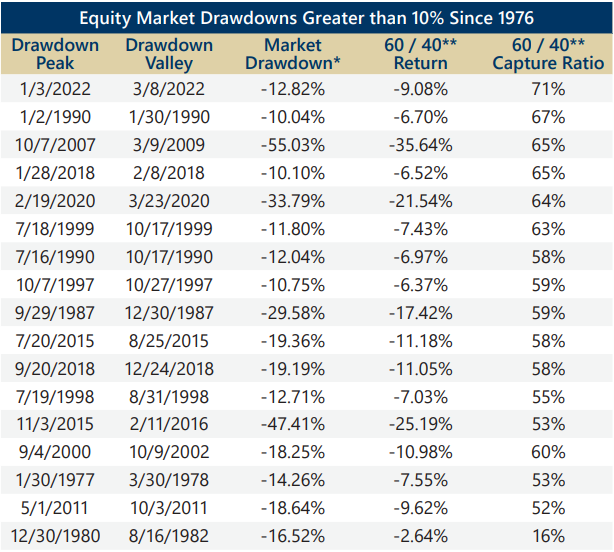

- The traditional 60/40 mix of stocks and bond had a loss of 9.08% from January 3 to March 8

while a stocks-only portfolio lost 12.82%. The 71% participation in the equity market’s loss was the traditional portfolio’s largest capture of a peak-to-trough equity market drawdown of 10% or more in over 45 years.

For investors interested in being less reliant on bonds for risk reduction, the first quarter 2022 results for the Cboe® S&P 500 BuyWriteSM Index and Cboe® S&P 500 PutWriteSM Index illustrate the potential benefits of managing risk and generating cash flow with index option writing in an elevated implied volatility environment. After experiencing less than half the loss of the S&P 500® Index from January 3 to March 8, both indexes had strong participation in the equity market’s quarter-end rally, which brought their year-to-date returns into positive territory in late March.

Well-above-average implied volatility levels resulted in monthly option writing premiums for the indexes that were greater than 2% in each month of the quarter. The above-average premium levels facilitated the option-writing indexes’ downside protection from the beginning of the quarter through March 8 and the strong participation in the equity market’s quarter-end rally.

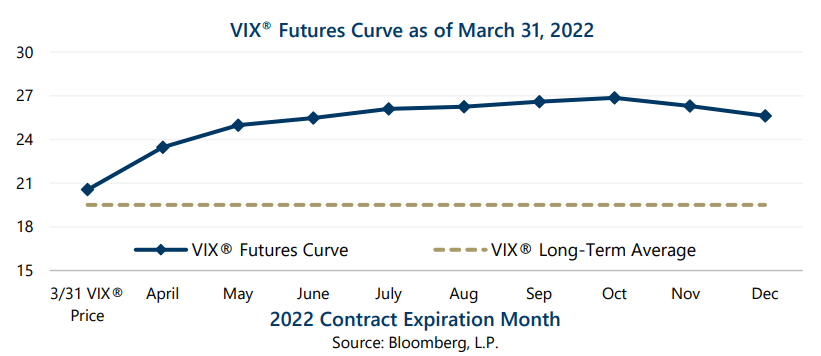

Though implied volatility, as measured by the Cboe® Volatility Index (the VIX®), trended down from its first quarter 2022 closing high of 36.45 as the market rallied in March, it remained above its long-term average of 19.52 at quarter-end with a closing price of 20.56 on March 31.

Conditions remain supportive of elevated implied volatility levels as many of the concerns that

drove volatility in the first quarter, including the war in Ukraine, record inflation and the pace of monetary tightening, have yet to be resolved. The VIX® futures curve at quarter-end also reflected market expectations that implied volatility will remain elevated, with contracts expiring in June through December all pricing at 25 or higher.

Utilizing index options for risk reduction and risk-adjusted return enhancement may have appeal for investors who are no longer satisfied with what the bond market has to offer. Low-volatility equity strategies that rely on cash flow from index option selling to both mitigate equity market losses as well as participate in equity market advances, like those managed by Gateway since 1977, may be a suitable alternative for investors who want to reduce their exposure to bonds without increasing overall portfolio risk.

Periods greater than one-year are annualized. Past performance is no guarantee of future results. Source: Morningstar DirectSM.

*Market data reflects results of the S&P 500® Index. **60 / 40 is comprised of 60% S&P 500® Index / 40% Agg.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.