Pandemic. War. Record inflation. Tightening monetary policy. Broken supply chains. Bellwether company earnings misses. Investors have faced a frightening litany of risks in 2022, and it is not surprising that the equity market is down and volatility measures are up. The market has teetered on the edge of the 20% decline that typically defines a bear market, but it hasn’t plunged deep into bear territory. Is this a sign of the market’s resiliency, or is a real bear market about to roar? Trends in implied volatility and the index put option market suggest a large number of investors are guarded against market losses. Whether this guarded stance is warranted is yet to be seen, but it has unquestionably had an impact on option and volatility markets so far in 2022.

Strong demand for index options in general, and index put options in particular, has resulted in elevated option prices. In a market environment that has not provided many positives, elevated premiums for strategies that write index options as a lower-risk way to participate in equity markets have been a bright spot. For example, the Cboe® S&P 500 BuyWriteSM Index (the BXMSM) and the Cboe® S&P 500 PutWriteSM Index (the PUTSM) have each collected a monthly premium of over 2% for writing their respective one-month at-the-money index options each month this year. The BXMSM and the PUTSM monthly premiums have averaged 2.28% and 2.49%, respectively, and both averages are about 27% higher than normal.

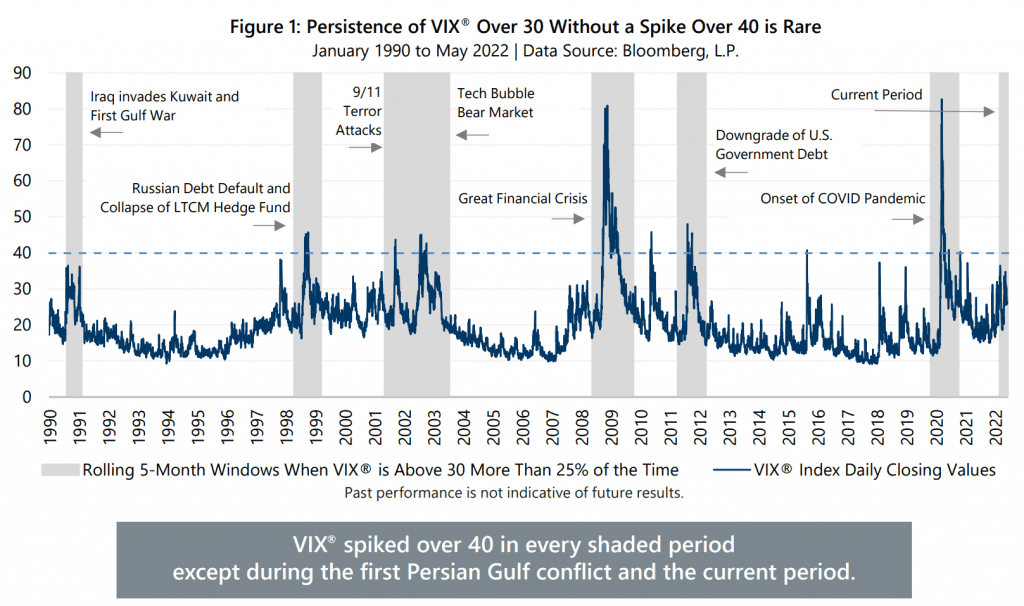

Attractive option premiums have been driven by persistently elevated implied volatility. Market declines, an uptick in realized volatility and general investor unease have combined to produce an average closing value of 26.01 for the Cboe® Volatility Index (the VIX®) this year, which is about 33% higher than its long-term average of 19.57. Moreover, well-above-average readings for the VIX® have been persistent in 2022. Daily closing values for the VIX® have been over 30 nearly 27% of the time this year through May 31. Such a high frequency of readings over 30 in a five-month period is rare – as Figure 1 shows, there have been just seven market environments in the history of the VIX® that have produced a 25% or higher frequency of readings above 30.

While the VIX® has been persistently elevated in 2022, it has not yet spiked above 40, making the recent volatility environment even more rare. All but one of the previous instances of the VIX® being persistently above 30 included a volatility spike that brought the VIX® to 40 or higher. Implied volatility spikes often occur when equity market value falls multiple percentage points in a single day, as it did in mid-May. However, the S&P 500® Index’s plunge of 4.02% on May 18 did not even push the VIX® to a new year-to-date high. The VIX® registered an intra-day high of 31.49 on May 18, lower than its 2022 high of 36.45, set on March 7. The intra-day high on May 18 was the second-lowest in history on days when the S&P 500® Index has declined 4% or more and more than 30% lower than the 45.58 average intra-day high on days when market falls between 4% and 5%.

While persistently elevated implied volatility has provided attractive option premiums for option sellers in 2022, the absence of dramatic increases in implied volatility during the steepest portions of this year’s market decline has resulted in less-than-spectacular gains for investors who seek downside protection from purchased index put options. Spikes in the VIX® can drive significant gains in put options, even when the index value does not fall below the strike price of a particular contract. Since such spikes have not materialized, price increases for out-of-the-money put options have been somewhat subdued during 2022’s market declines.

Ironically, evidence suggests it may be put option buyers themselves that have had the most influence on the rare combination of persistently elevated VIX® that has not spiked. The number of S&P 500® Index put options in the market, known as open interest, was nearly 20% higher at year-end 2021, compared to year-end 2020. The pandemic was a known risk factor for potential put buyers at both times, but rising tensions between Russia and Ukraine, increasing inflation and a potential shift in monetary policy were on the list of newer risk factors for investors to consider coming into this year. The higher index put option open interest suggests a general increase in investor desire for protection against one or more of those risk factors driving the market down. The market has been driven down by risk factors that were known prior to their impact on the market, and many investors who felt a need to be protected against such risk factors acquired protection before the market declined. Therefore, there has not been a spike in the VIX® because demand for downside protection has not suddenly and dramatically increased the way it does when less-anticipated risk factors drive the market down.

Index put option open interest has increased in 2022 and was over 16% higher on May 31 relative to year-end 2021. In its usual fashion, the number of outstanding index put contracts has dropped sharply at each standard expiration (typically the third Friday of each month), and then increased relatively steadily toward a higher level after each successive standard expiration. This trend in open interest suggests many investors who owned index put options coming into the year have replaced or even added to their protective positions as events have unfolded.

The current market dynamic is unique and creates potential opportunities for experienced index option managers who take an active approach and have the flexibility to respond to changing market conditions. Rather than trying to determine if the equity market has reached its low, or if, instead, the worst is yet to come, the investment team at Gateway will use their knowledge of option dynamics to keep strategies positioned to deliver loss mitigation if the market falls further, while also maintaining potential for participation in the event of an equity market recovery. Gateway’s approach combines decades of experience in options markets and flexible active management within a consistent risk framework, an approach designed to assist investors seeking attractive long-term returns with less risk than equity markets. We will remain vigilant, ready to respond as market and volatility conditions continue to evolve.

Past performance is no guarantee of future results.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.