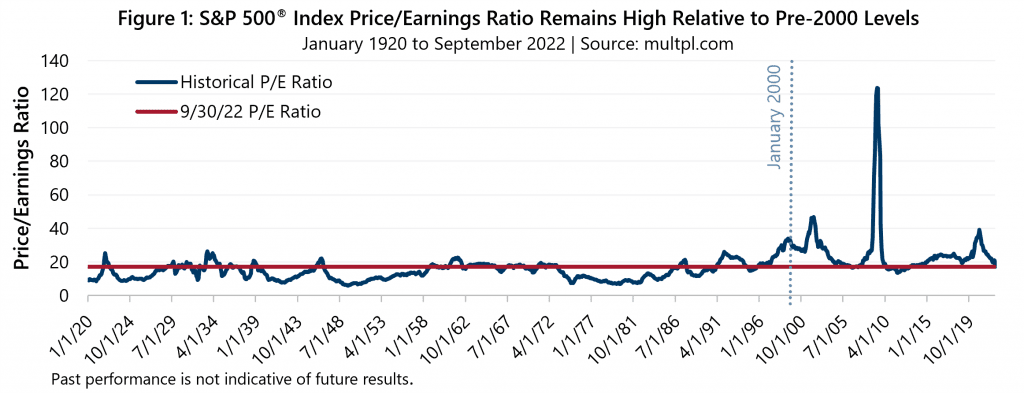

This year’s bear market has brought equity valuations lower, but are they low? The price-to-earnings ratio (P/E) of the S&P 500® Index began 2022 around 23, based on trailing 12-month earnings, and ended the third quarter around 17. Over the last 25 years, the average P/E is approximately 26 and readings below 17 have occurred just 14% of the time. As Figure 1 illustrates, current valuations are low relative to recent history. However, they are high relative to the range that persisted prior to 2000.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.