A question that we find ourselves asking more and more as 2023 continues to unfold, is how far…? How far can a market fall, or recover? How far can the Fed raise rates? How far can inflation rise, or fall, and most importantly, what does it mean for returns?

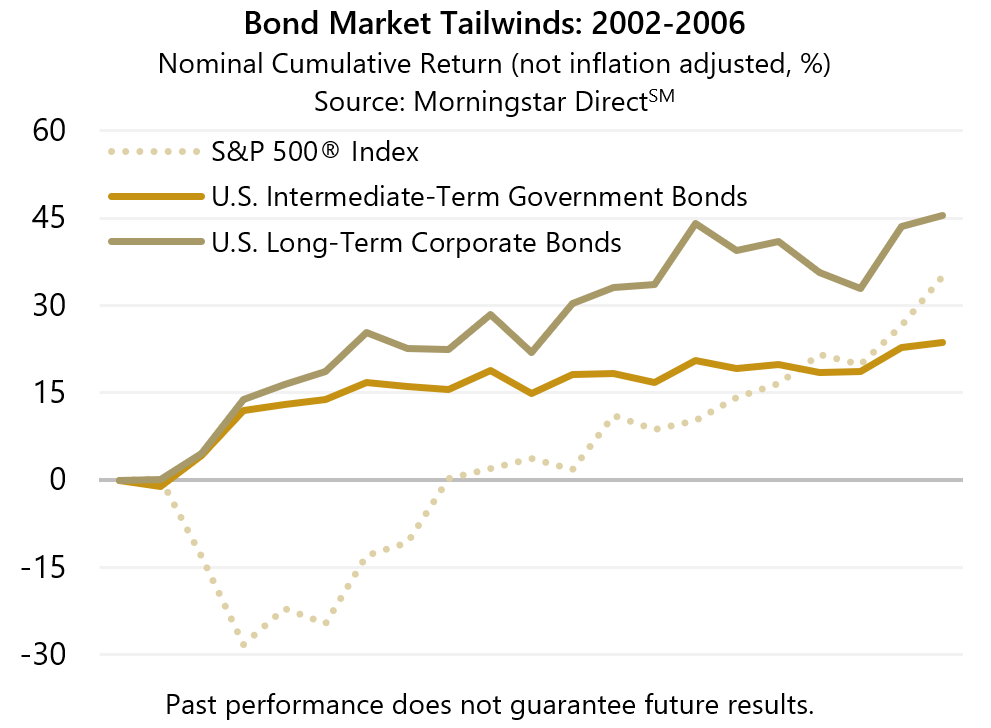

History has shown us that an allocation to fixed income after a bear market drawdown can offer investors upside potential, but not always. After the bear market decline of 2001, owning bonds helped investors recover losses while the equity market experienced additional declines. Attractive bond returns were facilitated by intermediate interest rates falling, as the bear market deepened. The 10-Year U.S. Treasury Note yield began 2002 above 5% and reached a low near 3% in mid-2003 while inflation averaged 2.7%.

Attractive but Volatile: Five-Year Returns After Bear Market Drawdowns

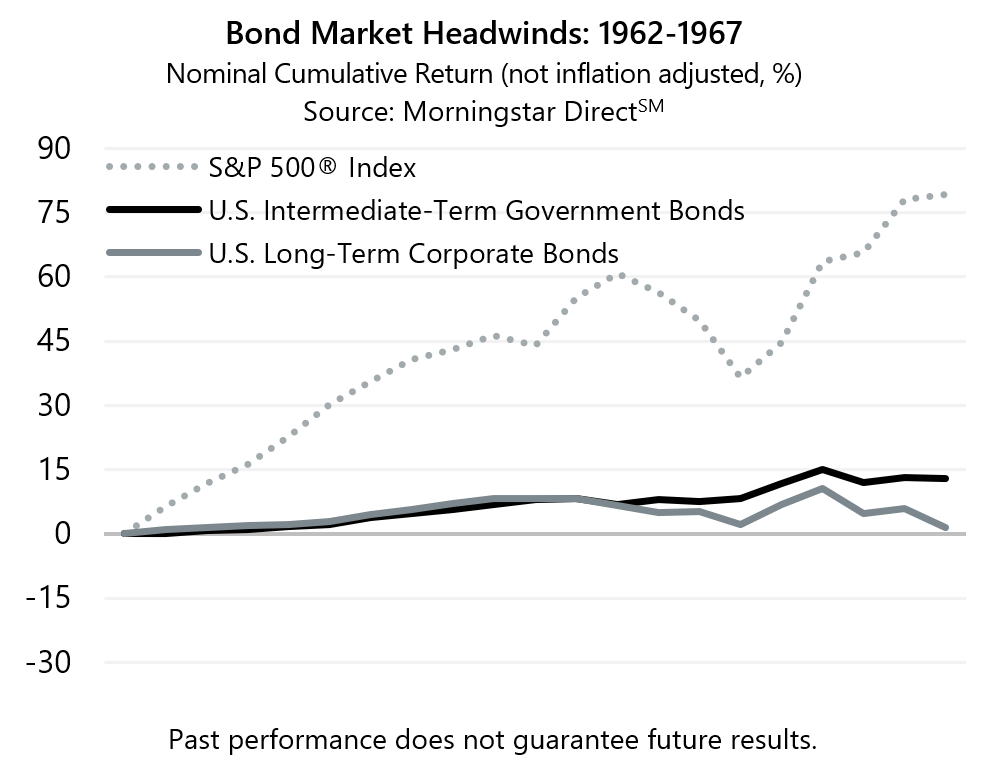

Looking back a bit further in time, after the bear market decline of 1961, bonds did little to help investors recover their losses – especially after accounting for annualized inflation exceeding 4%.

Fixed income investments were able to deliver acceptable total returns for investors following 2001, but not after 1962 (relatively flat absolute to slightly negative total returns when accounting for inflation).

Today, seemingly, looks and feels a bit more like 1963 than 2002 but what we do not know is what the equity market will deliver moving forward. Will it be more like 1963 and the beginning of a road to recovery, or will a 2002 environment present itself with more trouble ahead?

The losses incurred, and the often highly correlated downward moves between equity and fixed income markets last year, is still fresh on investors’ minds. There is much to be seen from the fixed income market for anyone to make the call that we are in the clear and allocations should be increased. For more, check out our latest Market Perspective – Real Return Conundrum: Between Rocky Volatility and an Inflationary Hard Place.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.