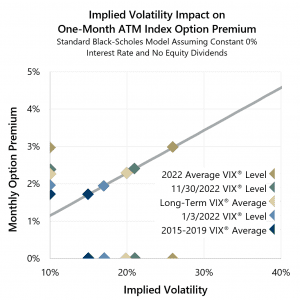

Higher implied volatility results in higher option premiums. Black-Scholes pricing model analysis of one-month at-the-money (ATM) S&P 500® Index call and put options utilized by the Cboe® S&P 500 BuyWriteSM Index (the BXMSM) and the Cboe® S&P 500 PutWriteSM Index (the PUTSM) shows that the volatility environment of 2022 has produced significantly higher option writing premiums relative to those available in the years of persistently below-average volatility that preceded the pandemic era.

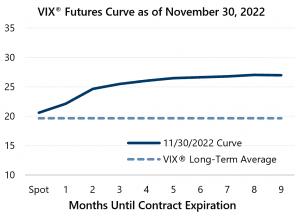

Implied volatility, as measured by the Cboe® Volatility Index (the VIX®), began the year below its long-term average but has spent much of 2022 at significantly higher levels. Implied volatility trended down as the market rallied in October and November but remained above average on November 30. Even though the BXMSM writes index call options and the PUTSM writes index put options, the volatility component of their respective options will be equivalent. The monthly premium for a one-month ATM option is more than one percentage point higher when its implied volatility is 26, relative to implied volatility of 17. With the VIX® futures curve on November 30 reflecting expectations of well-above-average implied volatility well into 2023, persistently elevated implied volatility may continue to be a positive contributor to option writing performance.

This could potentially add several percentage points to cumulative premium over a 12-month period, compared to the average level of implied volatility for the five years prior to the pandemic.

Past performance is not indicative of future results. Source: Bloomberg, L.P.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.