By several measures, 2022 provided investors with one of the most volatile and challenging years in history. Ongoing assessment of whether Federal Reserve (Fed) policy would be strong enough to tame inflation or too strong to avoid painful economic contraction, often drove intense market reactions to Fed decisions, utterances of Fed officials, and monthly releases of inflation and employment data. Fears that tightening was too aggressive contributed multiple steep market drops while hopes that the data would help the Fed find a reason to change course, or at least slow its pace, contributed to multiple blistering rallies.

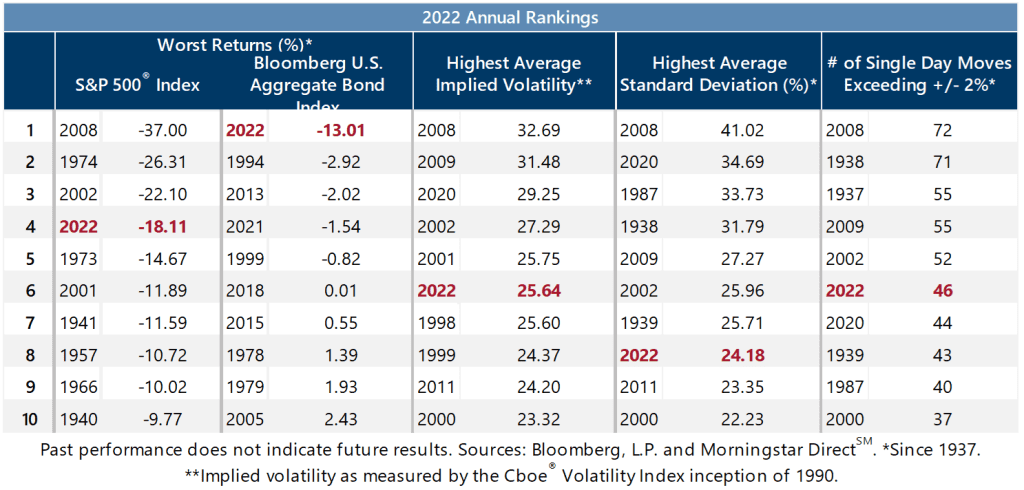

Realized volatility for the year, as measured by the standard deviation of daily returns for the S&P 500® Index, was 24.18%, the eighth highest reading in the past 85 years. Despite beginning the year at an intra-year closing value low of 16.60 on January 3, average implied volatility for the year, as measured by the Cboe® Volatility Index (the VIX®), was higher than realized volatility at 25.64 and ranked as the sixth highest annual average since its 1990 inception.

The defining feature of implied volatility in 2022, however, was its persistently above-average readings and relatively muted responses to sharp drops in equity market value. Typically, the VIX® reaches its highest levels when the equity market is at or near its low for the year or during multi-percentage point plunges. However, its intra-year closing high of 36.45 took place on March 7, well before the equity market reached its low for the year and in advance of the steepest portion of 2022’s bear market decline. The year featured multiple multi-percentage point single day declines, including nine that exceeded 3% and two that exceeded 4%, all of which occurred after the intra-year VIX® high on March 7.

This pattern of muted responses to equity market declines continued in the fourth quarter, as the VIX® had a lower average during December’s equity market selloff than its monthly averages for both October and November when the equity market was rallying. The VIX® ended the year at 21.67.

Past performance is not indicative of future results.