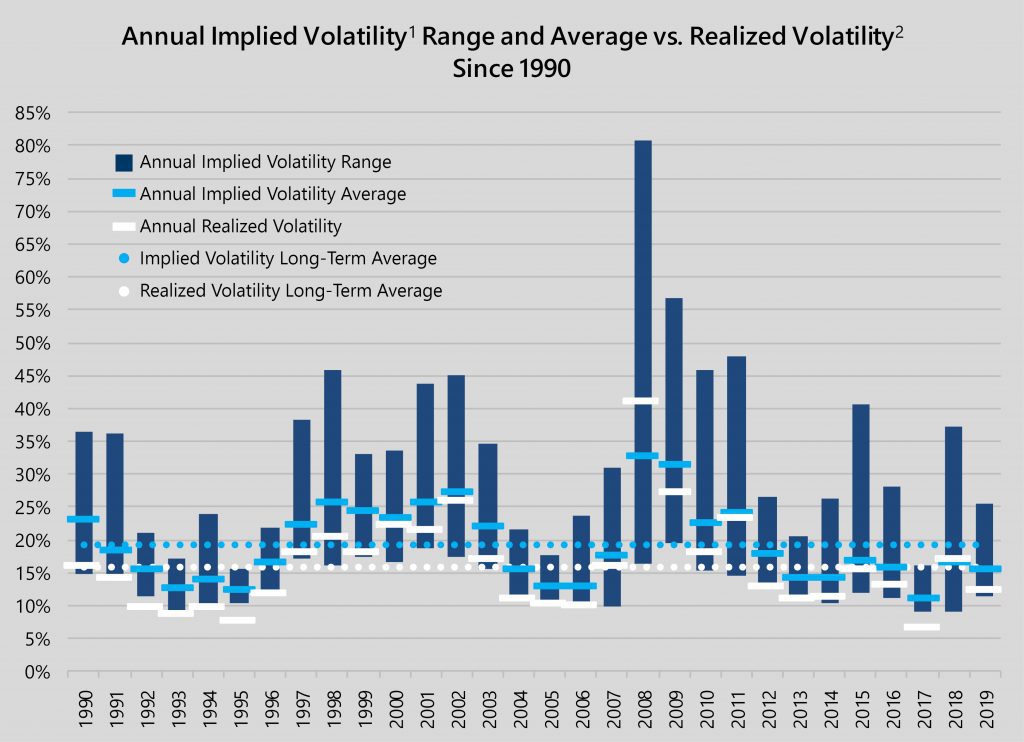

Implied volatility moderated in 2019, after spending much of 2017 at or near record lows and experiencing extreme highs during two volatility spikes in 2018. In 2019, the Cboe® Volatility Index® (the VIX®) adhered to the usual pattern of falling during market advances and increasing during market pullbacks. However, with a 2019 closing low of 11.54 on November 26 and a closing high of 25.45 on January 3, it did not collapse to record lows during the strong equity market advances in Q1 and Q4, nor did it spike to extremes during the market drawdowns of Q2 and Q3.

1: Implied volatility shown is based on the VIX® daily closing values. 2: Realized volatility is based on the standard deviation of daily returns for the S&P 500® Index. Source: Bloomberg, L.P.

Though the range of implied volatility was more moderate in 2019, it maintained the persistent below-average trend of recent years. The VIX® averaged 15.39 for the year, below its long-term average of 19.15. Despite below-average implied volatility levels, option writing indexes such as the Cboe® S&P 500 BuyWriteSM Index and the Cboe® S&P 500 PutWriteSM Index delivered returns that were not only above their long-term averages but also their best annual returns since 2009. The lack of a collapse in implied volatility despite strong equity market advances helped option writing returns in 2019. Option writing returns were also helped by a positive spread between implied and realized volatility. Realized volatility, based on the standard deviation of daily returns for the S&P 500® Index, came in at 12.47% for 2019, about three percentage points lower than average implied volatility. Notably, the relationship between implied and realized volatility returned to normal in 2019 after flipping in 2018 for the first time since 2009. Moreover, the relationship was persistent throughout the year with monthly averages for implied exceeding realized volatility in all but one month of the year.

What roles can option writing strategies play in investor portfolios in this environment? If current market and economic trends continue in 2020, then both the equity bull market and the U.S. economic expansion are poised to enter their 12th consecutive year in March and July, respectively. While the economic expansion has already set a record for duration, the equity market begins 2020 just a year-and-a-half shy of the longest bull market on record. A continuation of economic expansion, the equity bull market and the low volatility trend is uncertain due to several potential threats including domestic politics, geopolitical tensions and monetary policy challenges.

For investors who anticipate that recent market tranquility is temporary, option writing strategies that seek to consistently deliver lower risk and less downside than the equity market may be an appealing way to reduce equity market exposure and risk.

Investors with a more sanguine outlook may find the absolute return and risk-adjusted return potential of option writing strategies appealing relative to other lower volatility investments. A possible continuation of richer-than normal option pricing combined with low realized volatility creates the potential for option writing strategies to deliver attractive risk-adjusted returns with lower-than-normal volatility. Attractive risk-adjusted returns never go out of style and, in the current environment of low interest rates with the potential to rise over time, there are possible advantages to seek returns through allocations to option writing strategies. If low or rising interest rates keep bond market returns depressed, diversified investors may benefit from investments that do not have interest rate sensitivity and can complement intermediate to long-term bonds’ historical profile of low volatility and attractive risk-adjusted returns.

In either application, option writing exposure to richly-priced implied volatility has the potential to generate attractive risk-adjusted returns over the long-term.

Sources: Morningstar DirectSM, Bloomberg, L.P.

1: The Cboe® S&P 500 BuyWriteSM Index (the BXMSM) is a passive total return index designed to track the performance of a hypothetical buy-write strategy on the S&P 500® Index. The construction methodology of the index includes buying an equity portfolio replicating the holdings of the S&P 500® Index and selling a single one-month S&P 500® Index call option with a strike price approximately at-the-money each month on the Friday of the standard index-option expiration cycle and holding that position until the next expiration.

2: The Cboe® S&P 500 PutWriteSM Index (the PUTSM) is a passive total return index designed to track the performance of a hypothetical portfolio that sells S&P 500® Index (SPX) put options against collateralized cash reserves held in a money market account. The PUTSM strategy is designed to sell a monthly sequence of SPX puts and invest cash at one- and three-month Treasury Bill rates. The monthly sequence entails writing one-month SPX put options with a strike price approximately at-the-money each month on the Friday of the standard index option expiration cycle and holding that position until the next. The number of put contracts with identical strike prices and expiration dates sold varies from month to month but is limited so that the amount held in Treasury Bills can finance the maximum possible loss from final settlement of the SPX puts.