If the story of 2022 stock and bond market returns was written as a whodunit, the crack detective protagonist would have a primary suspect list that started and ended with rising interest rates. Higher interest rates and the higher volatility associated with uncertainty about the pace of monetary tightening have been a negative for stock and bond returns in 2022. However, both factors have a positive impact on call option premiums and have been beneficial to the relative performance of option writing indexes this year.

As of November 30, the Cboe® S&P 500 BuyWriteSM Index (the BXMSM) had a smaller year-to-date loss than both the S&P 500® Index and the Bloomberg U.S. Aggregate Bond Index (the Agg). Relative performance was also strong during the equity market advance and partial recovery in October and November, as the BXMSM captured over half of the 14.14% quarter-to-date return of the S&P 500® Index, while the Agg has returned 2.33%.

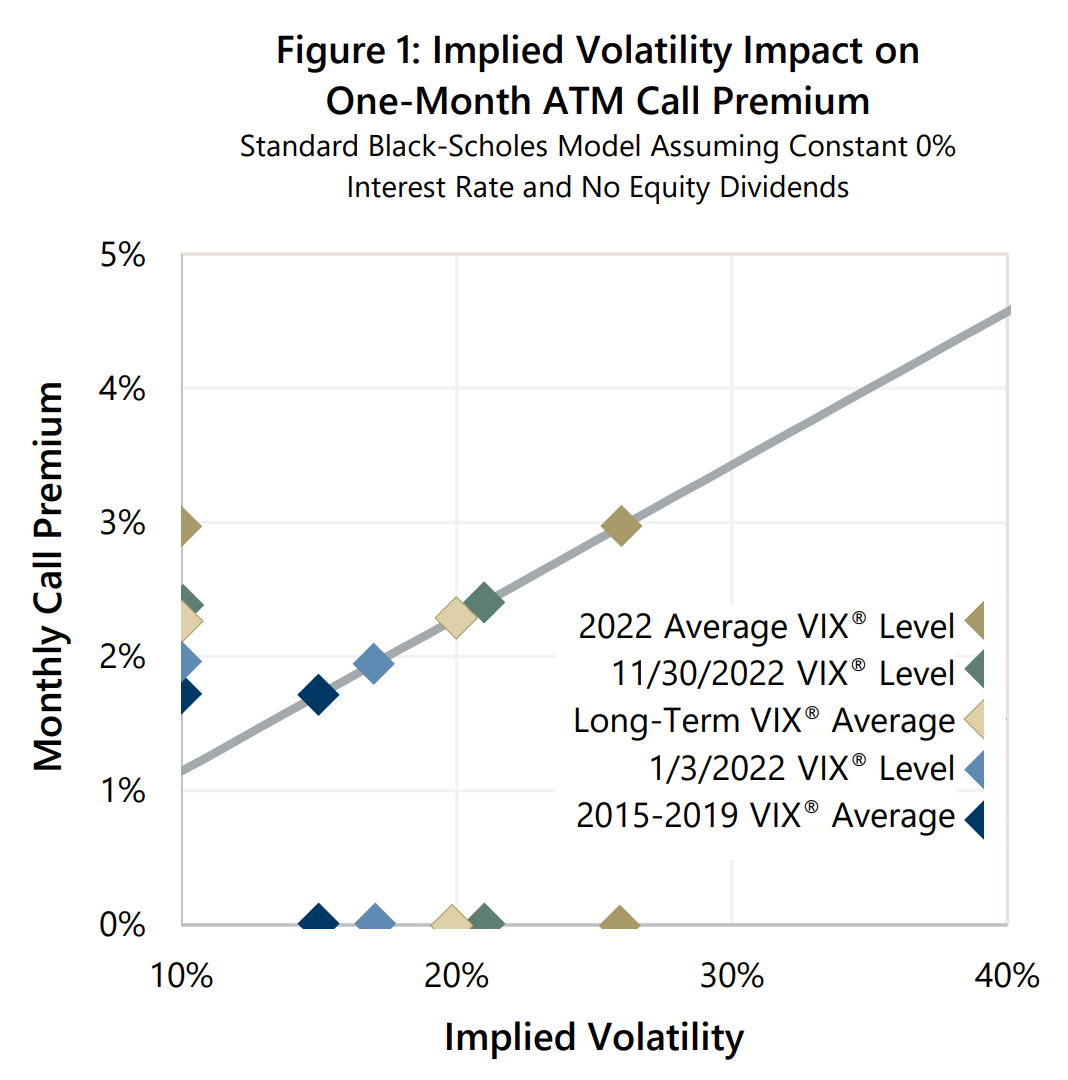

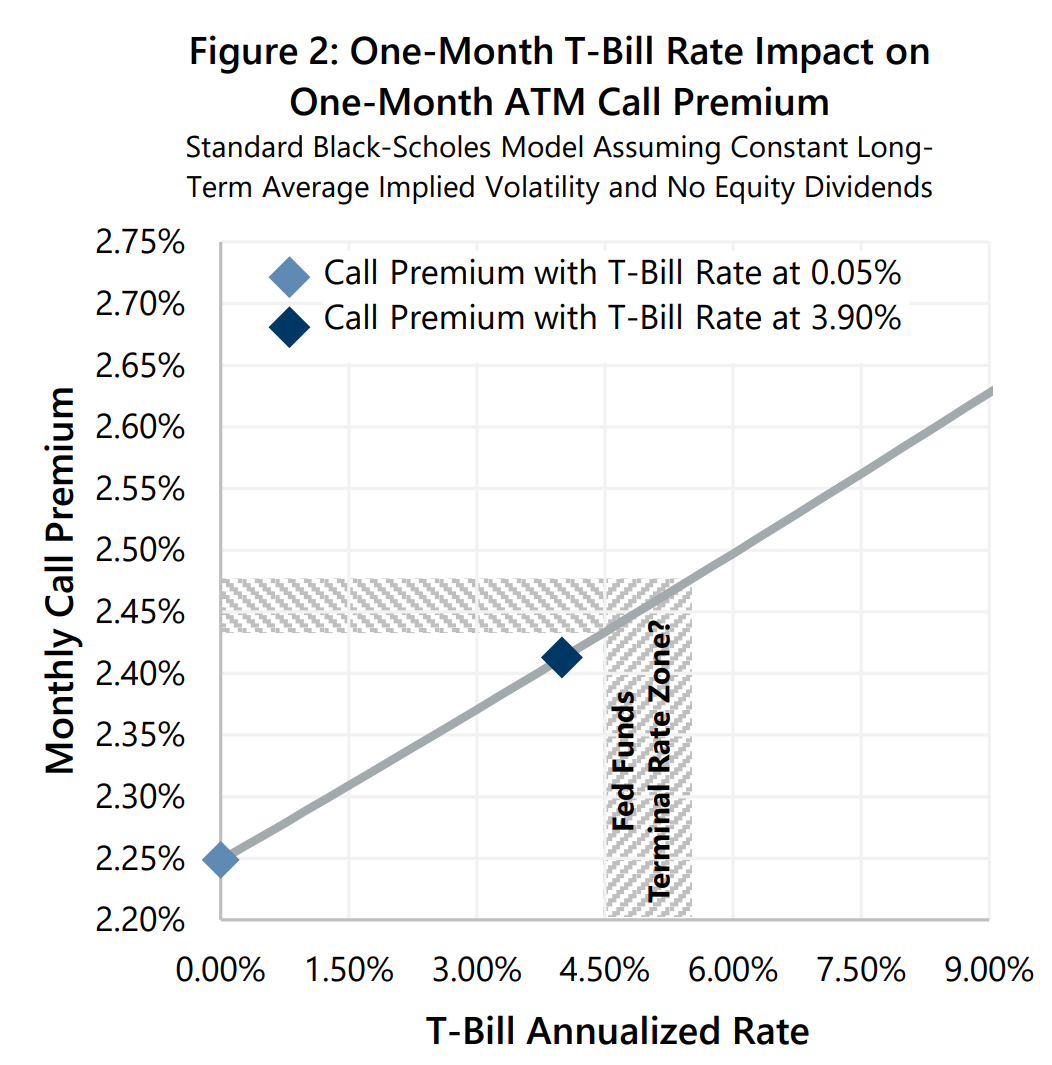

As Figures 1 and 2 illustrate, higher interest rates and elevated implied volatility both contribute positively to the monthly premium the BXMSM receives for writing a one-month at-the-money (ATM) S&P 500® Index call option.

As Figures 1 and 2 illustrate, higher interest rates and elevated implied volatility both contribute positively to the monthly premium the BXMSM receives for writing a one-month at-the-money (ATM) S&P 500® Index call option.

Implied volatility, as measured by the Cboe® Volatility Index (the VIX®), began the year below its long-term average but has spent much of 2022 at significantly higher levels. Implied volatility trended down as the market rallied in October and November but remained above average on November 30. The monthly premium for the BXMSM’s call option is more than one percentage point higher when its implied volatility is 26, relative to implied volatility of 17. With the VIX® futures curve on November 30 reflecting expectations of implied volatility ranging from 24 to 27 well into 2023, persistently elevated implied volatility may continue to be a positive contributor to option writing performance. This could potentially add several percentage points to cumulative premium over a 12-month period, compared to the average level of implied volatility for the five years prior to the pandemic.

When the one-month U.S. Treasury Bill (T-Bill) rate is at 3.90%, as it was on November 30, the premium for the call option the BXMSM writes is 16 basis points higher than when the one-month T-Bill yields 0.05%, as it was on January 3. If the Federal Reserve continues to move its policy rate higher, the interest rate component of option writing strategies could contribute up to one percentage point or more of return potential in 2023.

When the one-month U.S. Treasury Bill (T-Bill) rate is at 3.90%, as it was on November 30, the premium for the call option the BXMSM writes is 16 basis points higher than when the one-month T-Bill yields 0.05%, as it was on January 3. If the Federal Reserve continues to move its policy rate higher, the interest rate component of option writing strategies could contribute up to one percentage point or more of return potential in 2023.

It is an open and shut case: if current levels of volatility and interest rates persist, or move higher, option writing premiums may be an effective source of lower risk return potential as well as downside protection. Investment strategies that combine equity market exposure with cash flow from writing index options, like those managed by Gateway, may benefit from both higher levels of interest rates and implied volatility. Elevated cash flow provides strong return potential during market advances and attractive downside protection potential in down markets.

Rate and volatility data source: Bloomberg, L.P. Past performance is not indicative of future results. 1: With apologies to Agatha Christie, author of the 1944 murder mystery “Towards Zero”.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.