Savvy shoppers know a “25% Off” sale is not necessarily a good deal. Is the item discounted from a fair price or did the retailer increase the price before marking it down? Determining whether or not the equity market offers a compelling buying opportunity also requires more information than simply how much its price has fallen from its peak—even when the price has dropped by nearly 25%.

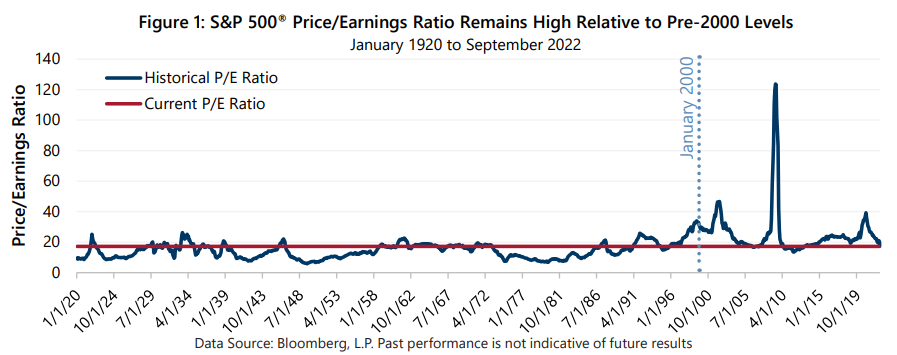

This year’s bear market has brought equity valuations lower, but are they low? The price-to-earnings ratio (P/E) of the S&P 500® Index began 2022 around 23, based on trailing 12-month earnings, and ended the third quarter around 17. Over the last 25 years, the average for the measure is approximately 26 and readings below 17 have occurred just 14% of the time. As Figure 1 illustrates, current valuations are low relative to recent history, however they are high relative to the range that persisted prior to 2000.

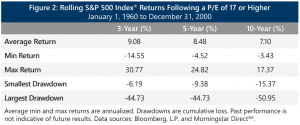

As the table in Figure 2 shows, when the starting P/E of the S&P 500® Index is 17 or higher, the average annualized returns over 3-, 5- and 10-year periods have been much higher than typical levels of inflation, and returns over these multi-year periods have frequently been higher than even the record level of inflation that the economy has been experiencing recently.

As the table in Figure 2 shows, when the starting P/E of the S&P 500® Index is 17 or higher, the average annualized returns over 3-, 5- and 10-year periods have been much higher than typical levels of inflation, and returns over these multi-year periods have frequently been higher than even the record level of inflation that the economy has been experiencing recently.

While long-term returns have historically been attractive on-average, history also suggests that when valuations are at current levels or higher, the market can deliver short-term losses that can test the commitment of long-term investors. Data in Figure 2 also shows that investing at valuation levels similar or higher than current levels can produce negative long-term returns as well as significant shorter-term drawdowns. With uncertainty over inflation and Federal Reserve (the Fed) policy, supply-chain issues, and the on-going conflict between Russia and Ukraine with the adjacent burgeoning European energy crisis, the current investment landscape includes multiple risk factors that could limit long-term returns and potentially trigger additional market downside.

At the end of the third quarter, equity market valuation was at a significant discount relative to valuation levels present for most of the 2000s. Investors may benefit from taking a longer view of history as they decide whether or not the current discount represents a compelling buy. History has shown that equity market returns from these valuation levels can be attractive, but investors must remain vigilant against downside risks. Strategies that utilize index options to reduce risk and generate attractive cash flow could be a great addition to any portfolio. With central bank policy, inflation and other potential risk factors present in fixed income markets, investors may be interested in alternatives such as the approach Gateway has taken to low-volatility equity investing since 1977.

Past performance is no guarantee of future results.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.