Wall Street has no shortage of adages and catch phrases. When the equity market hits the skids, old saws such as “be fearful when others are greedy and be greedy when others are fearful” encourage investors to be contrarian and seek opportunity where others find misfortune. There is an analogous saying associated with the Cboe® Volatility Index (the VIX®) that appeals to those who prefer cliches that rhyme: “When the VIX® is high, it’s time to buy. When the VIX® is low, look out below.” While these sayings are catchy and contain a modicum of insight on how some experienced investors tend to navigate the markets, they fall short of being effective signals for precisely when to buy and sell stocks.

For example, from mid-2012 through 2017 the VIX® was persistently low, rarely rising above its long-term average. Not only were equity market returns well-above average over this period, but the S&P 500® Index only had one drawdown that exceeded 10% – a 12.04% loss that lasted less than five weeks in the summer of 2015. Conversely, the VIX® was persistently above-average from the late 1990s into the early 2000s, a period that witnessed a S&P 500® Index drawdown of over 47% from September 2000 into October 2002. Additionally, if above-average market returns or above-average market valuations are signs that investors are “greedy,” those heeding the adage coined by Warren Buffet would have spent almost the entire decade of the 2010’s too fearful to enter the equity market and missing out on well-above-average returns.

After the worst first six months of a year in more than five decades, many investors are fearful and the VIX® is well-above average. Should investors be taking their cues from snappy sayings? Long-term investors who want to avoid the anxiety of being “all in” or “all out” may benefit from low volatility equity strategies that combine equity market exposure with cash flow from selling index options. Such strategies can help investors stay focused on the long-term by softening the impact of market direction over the short-term.

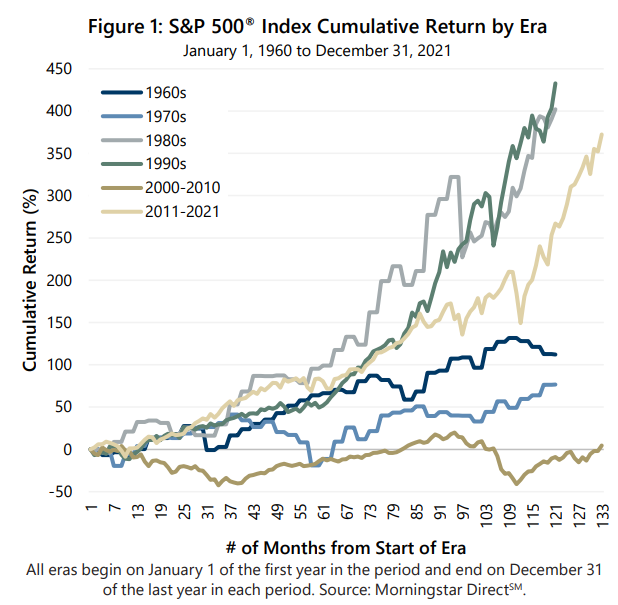

While market pullbacks and volatility spikes in recent years have proven to be opportunities to buy into an equity market that would soon resume its rapid advance, Figure 1 illustrates that the market has had extended eras when downside volatility was not a harbinger of immediate upside opportunity. What can long-term investors do to prepare for the possibility that the next era is different than the last several years?

Index option-based low volatility equity strategies provide a unique opportunity for investors. The equity market exposure of such strategies can be beneficial when equity market returns are positive, while cash flow from index option selling can mitigate losses when equity market returns are negative. Importantly, the cash flow potential from such strategies tends to increase as equity market volatility rises. Furthermore, rising interest rates do not have a negative impact on cash flow generated by selling index options.

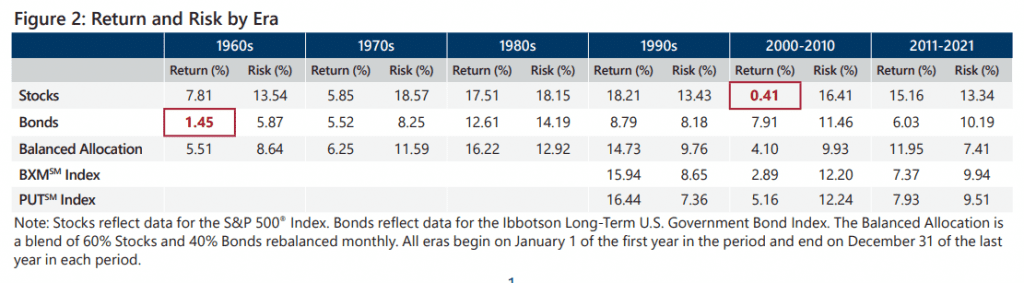

This combination of characteristics makes index option-based low volatility equity strategies a potentially valuable component of diversified portfolios in a wide range of long-term scenarios. If the current bear market is followed by a resumption of above-average equity market returns, in a pattern similar to recent years, index option-based low volatility equity strategies may generate lower returns than the equity market but offer better return potential than bonds, especially if interest rates remain at current levels or rise.

If equity market returns are moderate or flat for an extended period of time, index option writing cash flow is a source of return potential that can help keep pace with or potentially exceed equity market returns. In this scenario, option writing cash flow offers long-term return potential that is attractive relative to bonds if the long-term interest rate trend is rising, flat or declining back toward historic lows.

Finally, if the equity bear market becomes prolonged, index option-based low-volatility equity strategies offer meaningful loss mitigation potential from index option writing cash flows. Mitigating losses preserve capital, potentially allowing for more of the portfolio to participate in the equity market’s eventual recovery. In this scenario, bonds may be a better source of capital preservation as the equity market declines but also represent a ballast in the portfolio that potentially has limited participation in the equity market’s eventual recovery.

Are inflation and rising interest rates ushering in a new investment era? Or will the market resiliency of recent years continue? It may be too early to make that call. Strategies that combine equity market exposure with cash flow from index options that reduces risk while providing an additional source of potential return may have appeal for diversified, long-term investors who are uncertain about what lies ahead for the asset classes they are exposed to. For nearly 45 years, Gateway has provided access to the unique potential of option strategies, helping investors navigate the ups and downs of both the equity and bond markets.

Past performance is no guarantee of future results.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.