With the Federal Reserve (the Fed) gearing up to fight inflation with a dose of monetary tightening, what can long-term, diversified investors expect from their bond allocations? Despite the return-boosting rate cuts instituted at the beginning of the pandemic, the Bloomberg U.S. Aggregate Bond Index (the Agg) has produced an annualized return of less than 1% over the last two years. Investors who rely on bonds for risk-reduction rather than return generation may be able to overlook that paltry showing. However, a return pattern of posting negative returns in 12 of the last 24 months, including six of eight months in which the S&P 500® Index return was negative, may have investors wondering if bonds can still deliver diversification benefits as part of the risk-reduction equation. Examining bond market returns during past monetary tightening phases only reinforces the reduced value proposition of bond market exposure.

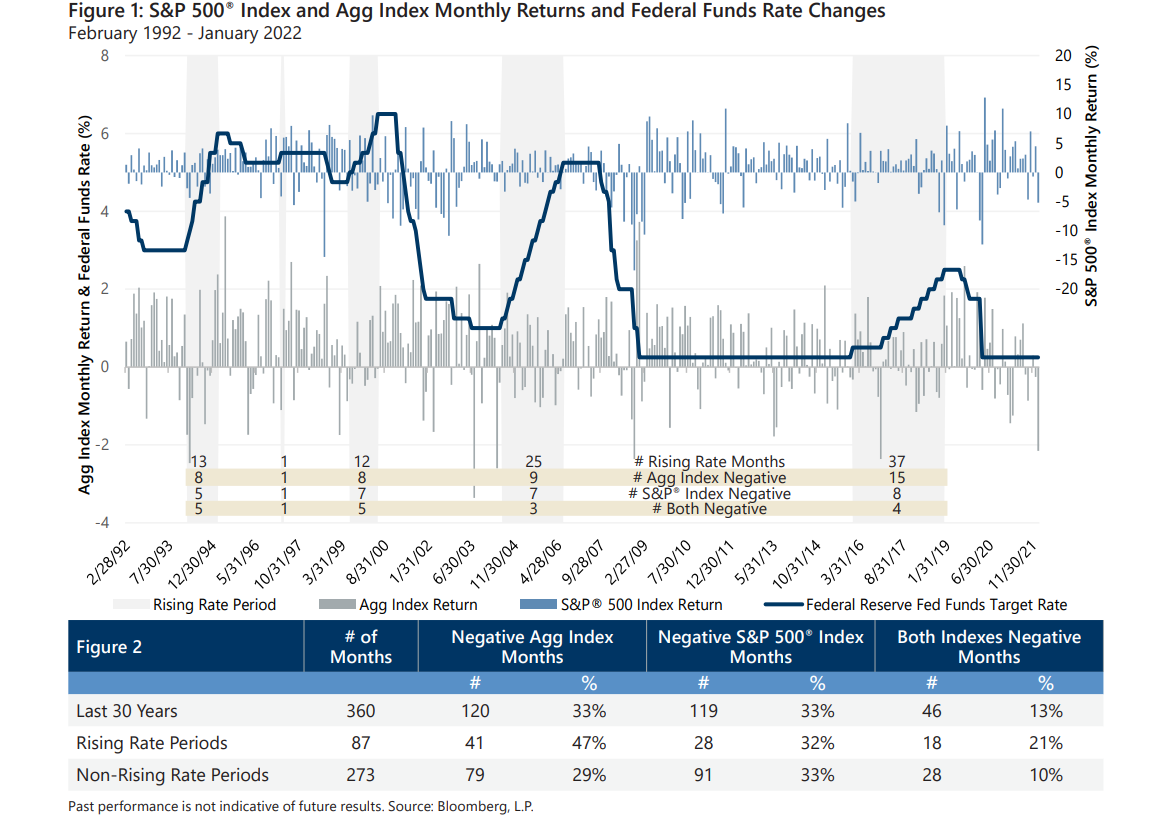

Over the past 30 years, the Fed has executed four extended periods of rate hikes and a one-time hike in 1997. As Figures 1 and 2 show, the Agg had a higher frequency of negative monthly returns over the periods of rate increases. Moreover, the frequency of simultaneous negative returns for the Agg and the S&P 500® Index has been twice as high during rising rate periods than during non-rising rate periods.

It is worth noting that the overall frequency of negative equity market returns was approximately 33% in both rising rate periods and non-rising rate periods. Further analysis reveals that the frequency of negative equity market returns was lower in the last two rising rate periods and much higher during the earlier rising rate regimes.

Given recent equity market volatility, prudent investors may be hesitant to increase equity exposure in hopes of avoiding the historical frequency of bond market losses during the anticipated rising rate period ahead. Low-volatility equity strategies that rely on cash flow from index option selling to both mitigate equity market losses as well as participate in equity market advances, like those managed by Gateway, may be a suitable alternative for investors who want to avoid interest rate sensitive investments without increasing overall portfolio risk. Gateway’s low-volatility equity strategies strategically and consistently seek to reduce the risk of their underlying equity exposure, creating the potential to limit losses during equity market declines and capture a majority of the long-term return of the equity market with lower risk.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.